-

Net Loss: Reported a net loss of $10 million, or $0.14 per diluted share, falling

shortthe estimated earnings per share of $0.63. -

Adjusted Net Income: Adjusted net income reached $54 million, or $0.75 per diluted share,

surpassingthe estimated net income of $47 million. -

Revenue: Total operating revenues were $454 million,

belowthe estimated revenue of $483.31 million. -

Free Cash Flow: Generated $33 million in free cash flow during the quarter.

-

Shareholder Returns: Returned $79 million to shareholders through share repurchases and dividends.

-

Production Levels: Maintained flat gross production at 94 thousand barrels of oil equivalent per day (MBoe/d).

-

Operating Costs: Operating costs reduced to $176 million from $186 million in the previous quarter.

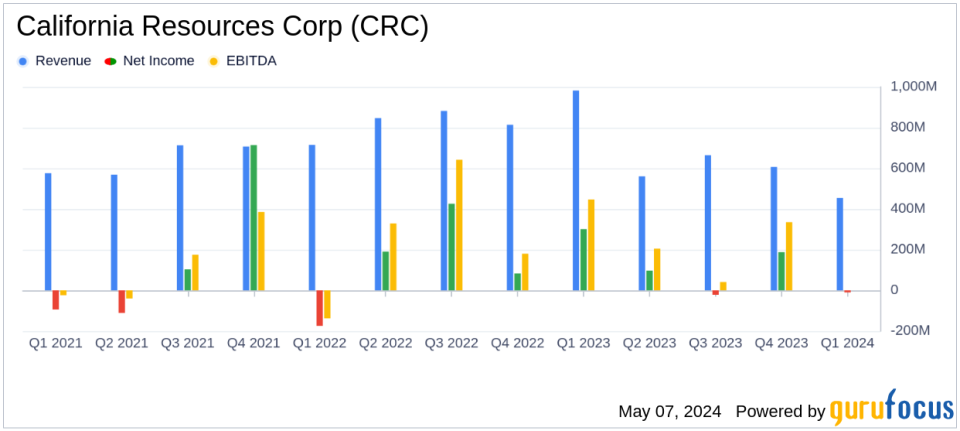

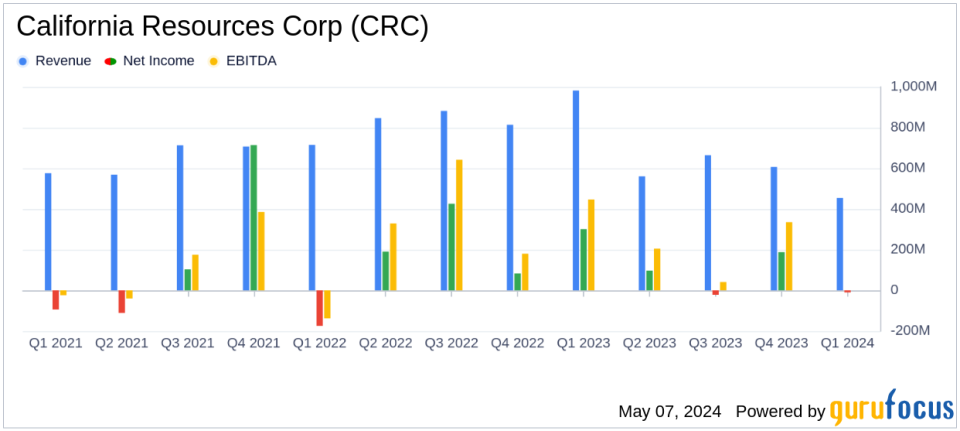

On May 7, 2024, California Resources Corporation (NYSE:CRC) disclosed its financial and operational results for the first quarter of 2024 through an 8-K filing. The company, a leading independent oil and natural gas exploration and production company in California, reported a net loss of $10 million, or $0.14 per diluted share. However, when adjusted for specific one-time costs and non-recurring expenses, CRC’s adjusted net income stood at $54 million, or $0.75 per diluted share, significantly outperforming the analyst estimate of $0.63 per share.

California Resources Corp is dedicated to providing energy in a responsible manner, focusing on low carbon intensity production and carbon capture and storage (CCS) projects to support California’s energy needs and environmental goals.

Financial Highlights and Operational Performance

CRC returned $79 million to shareholders through dividends and share repurchases, underscoring its commitment to shareholder returns. The company generated $87 million in net cash from operating activities and achieved an adjusted EBITDAX of $149 million. Despite facing operational challenges such as extended maintenance at the Elk Hills power plant and adverse weather conditions, CRC maintained a flat production profile, delivering an average quarterly net production of 76 thousand barrels of oil equivalent per day (MBoe/d).

The financial period was marked by significant strategic activities, including the ongoing Aera Merger, set to enhance CRC’s operational scale and financial robustness. The merger is anticipated to close around mid-year 2024, subject to regulatory and shareholder approvals.

Strategic Developments and Market Positioning

In addition to its operational metrics, CRC’s strategic initiatives have positioned it as a leader in the energy sector’s transition towards more sustainable practices. The company’s Carbon TerraVault JV achieved a milestone by securing a $46 million contribution for a reservoir space project, further advancing its CCS capabilities.

Operationally, CRC has adapted to market conditions by optimizing its cost structure and enhancing operational efficiency, which is evident from the reduced operating costs from $186 million in Q4 2023 to $176 million in Q1 2024. These improvements are crucial as the company prepares for the integration with Aera Energy, aiming to create a more robust entity capable of delivering enhanced shareholder value.

Challenges and Forward-Looking Strategies

Despite the positive adjusted earnings, CRC faced a net loss this quarter, primarily due to non-recurring costs associated with the Aera transaction and maintenance-related energy cost increases. The company also navigated production setbacks due to maintenance overruns and adverse weather, impacting its output by approximately 1.5 MBoe/d from the forecasted levels.

Looking ahead, CRC is focused on closing the Aera Merger and expanding its carbon management business. The company’s guidance for 2024 excludes the pending merger but anticipates a capital program of $200 million to $240 million, aimed at bolstering oil and natural gas development and advancing carbon management projects.

Conclusion

California Resources Corp’s first quarter of 2024 illustrates a resilient performance amidst operational and market challenges. The company’s strategic focus on shareholder returns, coupled with its commitment to sustainability and efficient energy production, positions it well for future growth, especially with the impending Aera Merger. As CRC continues to navigate the complexities of the energy market, its efforts to enhance shareholder value and maintain operational excellence are evident in its robust financial and operational strategies.

For detailed insights into CRC’s financials and strategic initiatives, investors and stakeholders are encouraged to view the full earnings report and supplementary materials available on the company’s website.

Explore the complete 8-K earnings release (here) from California Resources Corp for further details.

This article first appeared on GuruFocus.