Introduction to the Transaction

In a recent move that has caught the attention of the investment community, Warren Buffett (Trades, Portfolio)’s firm has added a significant number of shares to its portfolio in Liberty SiriusXM Group (NASDAQ:LSXMK). The transaction, which took place on April 26, 2024, involved the acquisition of 69,691,260 shares, reinforcing the firm’s confidence in the media company. This strategic addition underscores the firm’s ongoing commitment to investing in value-driven companies with strong long-term prospects.

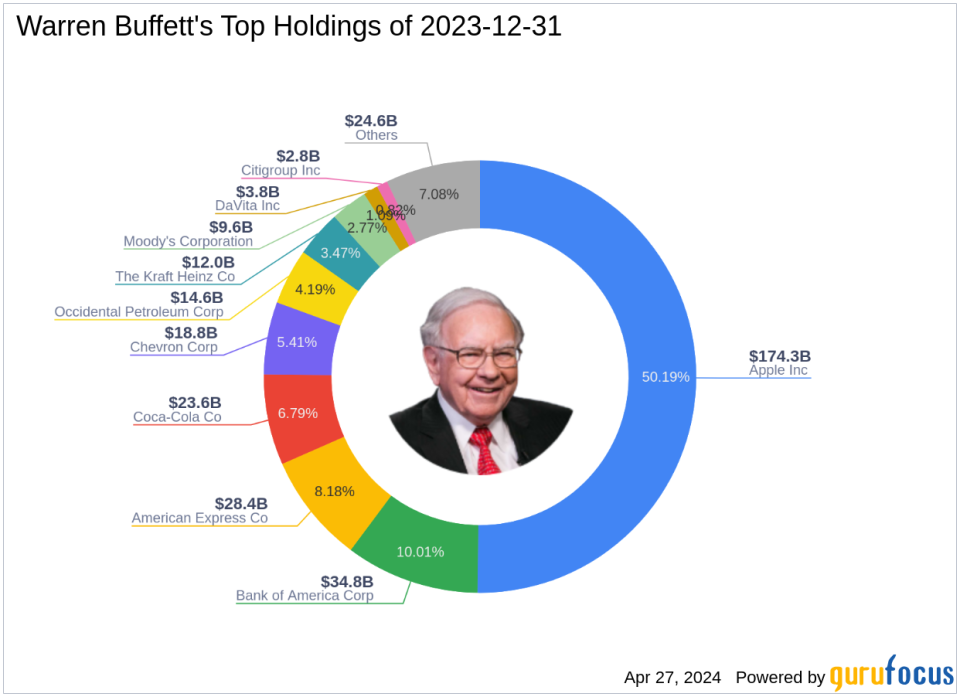

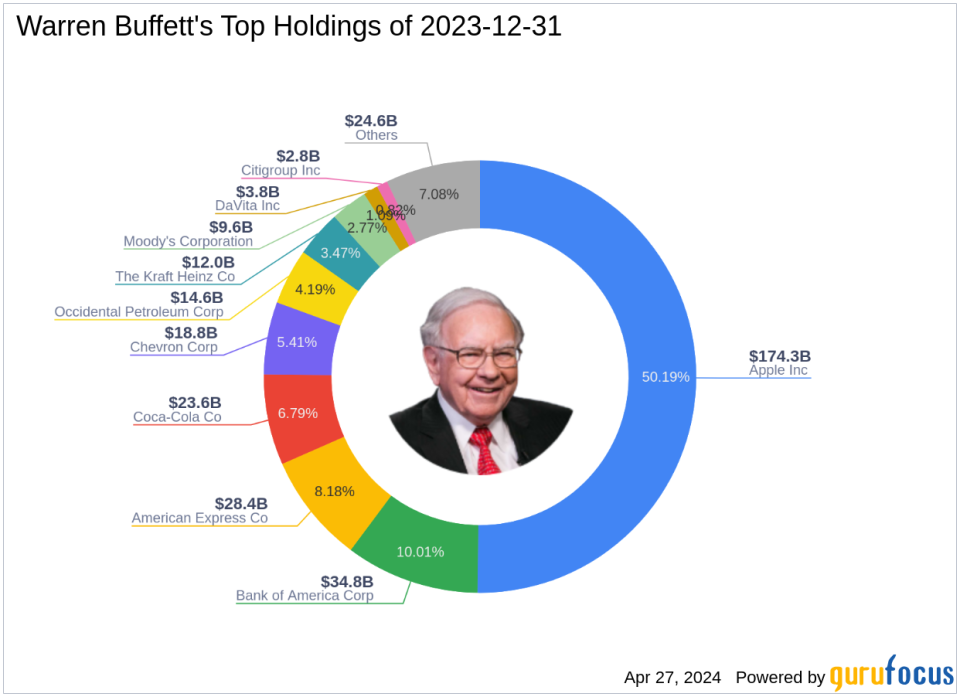

Guru Profile: Warren Buffett (Trades, Portfolio)

Warren Buffett (Trades, Portfolio), often referred to as “The Oracle of Omaha,” is a towering figure in the investment world. His firm, Berkshire Hathaway, is a testament to his investment acumen, having evolved from a textile manufacturer into a global conglomerate. Buffett’s value investing strategy, which he honed under the tutelage of Benjamin Graham, focuses on acquiring undervalued companies with enduring qualities and holding them over the long term. His investment decisions are closely monitored by investors worldwide for their potential market impact.

Transaction Details

The recent trade saw Buffett’s firm add 647,016 shares of Liberty SiriusXM Group at a price of $24.53 per share. This move has not significantly impacted the overall portfolio, with a trade impact of 0%. However, it has increased the firm’s position in the company to 0.49% of the portfolio, representing a 21.34% ownership stake in LSXMK. This transaction reflects the firm’s ongoing strategy of investing in companies with favorable long-term prospects.

Liberty SiriusXM Group Overview

Liberty SiriusXM Group, trading under the stock symbol LSXMK, is a prominent player in the media industry in the United States. Since its IPO on April 18, 2016, the company has been engaged in providing subscription-based satellite radio services through its segments, including Sirius XM Holdings, Braves Group, and Formula One Group. The company’s services are widely distributed across the US and UK, catering to a diverse audience with a variety of music, sports, entertainment, and news content.

Financial Analysis of Liberty SiriusXM Group

With a market capitalization of $7.93 billion and a current stock price of $24.27, Liberty SiriusXM Group is positioned as a modestly undervalued entity according to GuruFocus valuation metrics. The stock’s P/E ratio stands at 10.60, and the GF Value is calculated at $30.82, indicating a stock price to GF Value ratio of 0.79. Despite a slight decline of 1.06% since the trade date, the stock has experienced a 13.63% increase since its IPO and a year-to-date change of -15.67%.

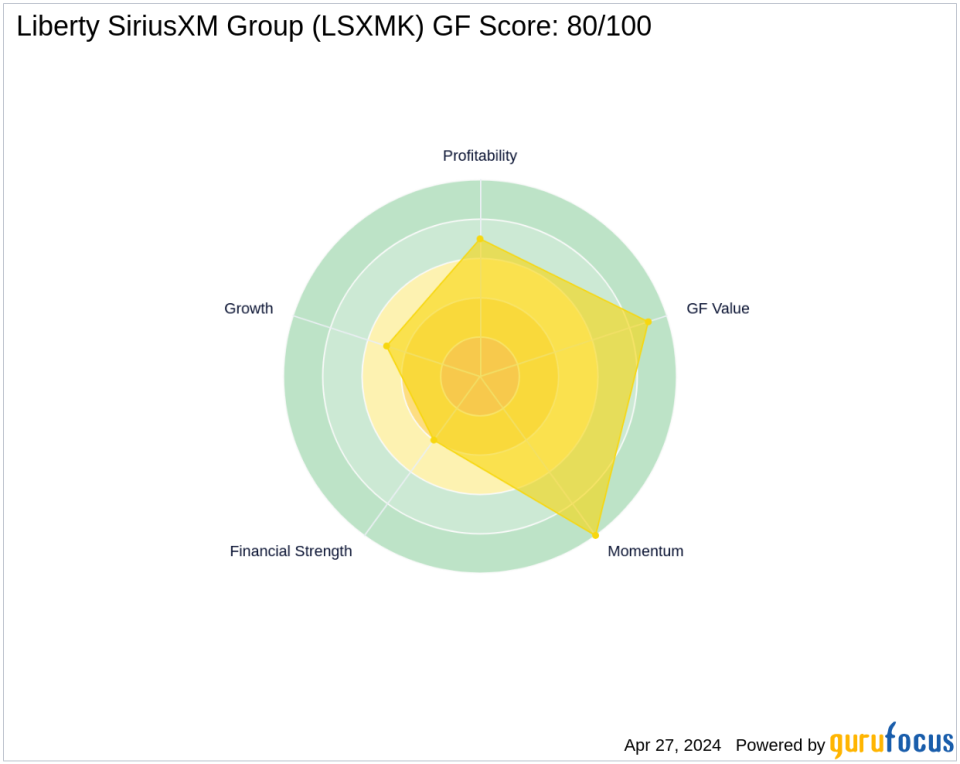

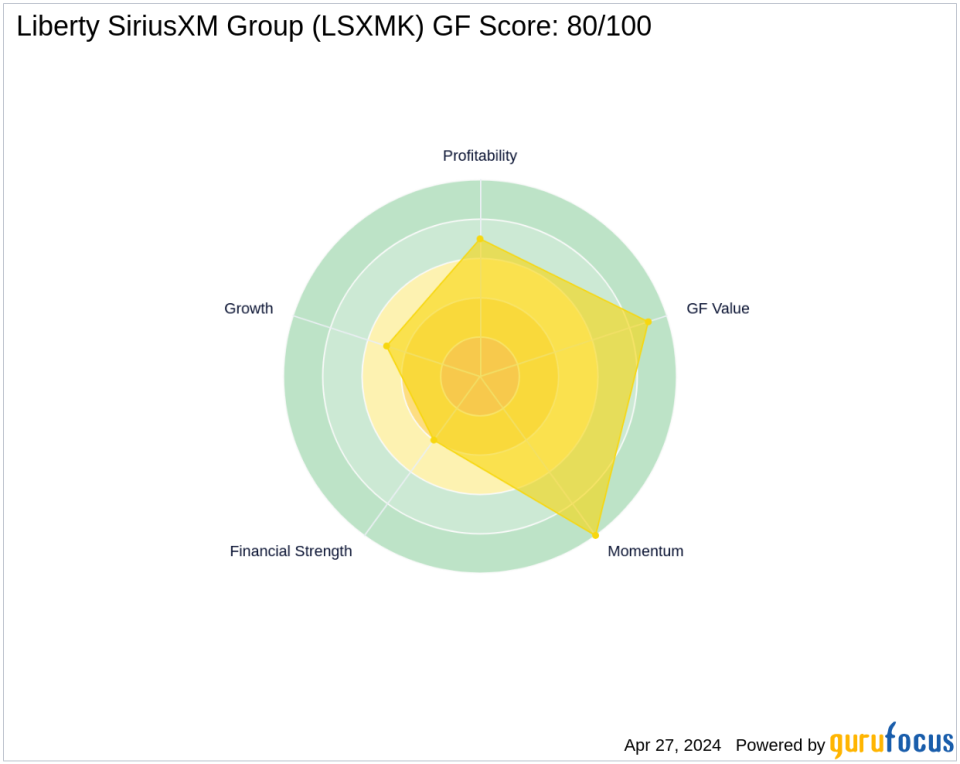

Performance Metrics and Rankings

Liberty SiriusXM Group boasts a GF Score of 80/100, suggesting good outperformance potential. The company’s financial strength and profitability are reflected in its balance sheet and profitability ranks of 4/10 and 7/10, respectively. Growth and GF Value ranks are 5/10 and 9/10, while the Momentum Rank stands at a perfect 10/10. The firm’s financial health indicators, such as cash to debt ratio of 0.03 and interest coverage of 3.54, further demonstrate its stability. GF-Score

Comparative Guru Holdings

Buffett’s firm, Berkshire Hathaway, is the largest guru shareholder of Liberty SiriusXM Group, with a commanding share percentage. Other notable investors who hold positions in LSXMK include Seth Klarman (Trades, Portfolio), Wallace Weitz (Trades, Portfolio), and Mario Gabelli (Trades, Portfolio), indicating the stock’s popularity among savvy value investors.

Market Context and Performance

Since its IPO, Liberty SiriusXM Group’s stock has shown resilience and growth, with a positive trajectory over the long term. The stock’s momentum and relative strength index (RSI) rankings reflect its current market position, with RSI indicators suggesting it may be approaching oversold territory, which could interest value investors looking for potential entry points.

Transaction Analysis

Warren Buffett (Trades, Portfolio)’s recent acquisition of additional shares in Liberty SiriusXM Group is a testament to the firm’s confidence in the company’s value proposition and future prospects. This move is likely to have a positive influence on the stock, as market participants often view Buffett’s investment decisions as a signal of strong fundamentals and potential for growth. As the largest guru shareholder, the firm’s increased stake in LSXMK could also draw further investor interest to the stock.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.