The UK’s tax take has increased faster than any other major economy since 2019, according to new research from the Institute of Fiscal Studies (IFS).

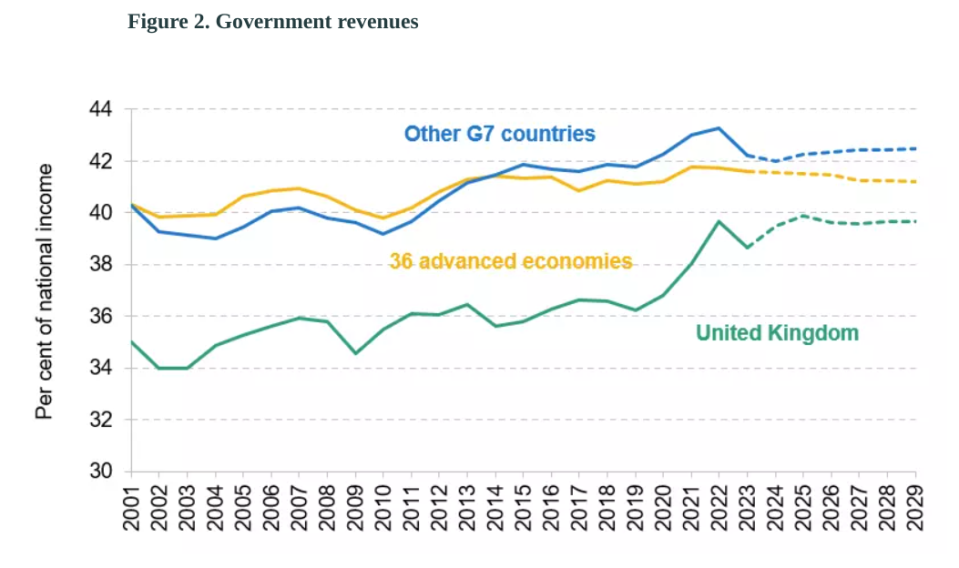

Although the UK started the century with tax revenue making up a much lower proportion of national income than other advanced economies, the tax burden has rapidly climbed since the pandemic.

The research found that between 2001 and 2019, tax revenue was around five per cent of national income lower than other advanced countries. Since 2019, however, this gap has narrowed. By 2029 the gap between the UK and other advanced economies will be 2.8 per cent of national income.

The research is based on the International Monetary Fund’s latest forecasts and compares the UK’s fiscal fortunes with 36 other advanced countries around the world.

Among the most important tax increases since the pandemic have been the big increase in corporation tax, from 19 per cent to 25 per cent, and the windfall tax on oil and gas companies.

Personal tax thresholds have also been frozen since April 2021 This has seen more and more people dragged into paying higher taxes as wages have climbed in response to inflation, a phenomenon known as fiscal drag.

The Conservatives have announced two cuts to national insurance in recent months, however much of that impact has been wiped out by fiscal drag.

Yesterday, Chancellor Jeremy Hunt signalled his ambition to cut taxes again in the autumn if the situation allows.

Even so, the Office for Budget Responsibility (OBR) expects the tax burden to rise to 37.1 per cent of GDP in 2028-29, four percentage points higher than pre-pandemic.

While government revenues have increased, the research also noted that government spending has too – and at a faster pace.

“Our appetite to become a more average spender has not been fully matched by a willingness to become a more average taxer,” the IFS said.

The research also pointed out that weak economic growth since the pandemic has made the government’s fiscal choices harder.

Although the UK outperformed the average between 2001 and 2019, it is forecast to have the seventh worst performance between 2019 and 2029. Lower growth depresses government revenue.

“The UK started this century with a smaller state, lower taxes and lower debt than most of its peers. Almost twenty-five years and three large crises later, this has changed: the UK now looks much more like a typical advanced economy in fiscal terms,” Martin Mikloš, research economist at the IFS said.