-

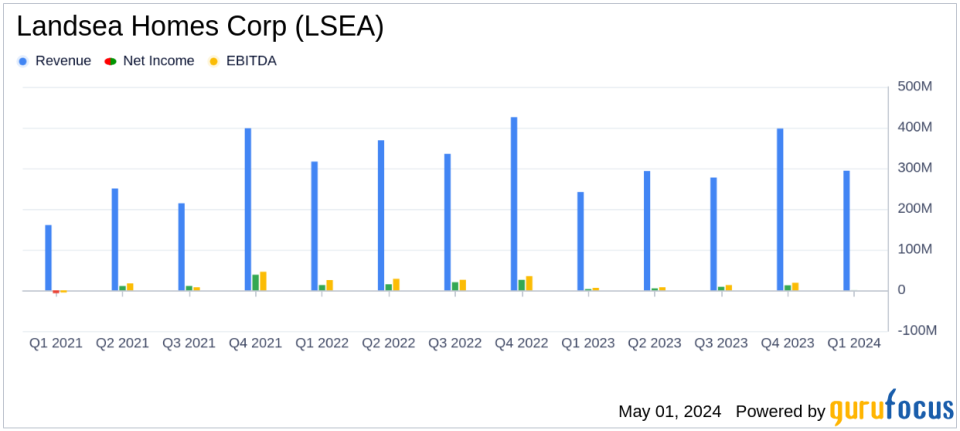

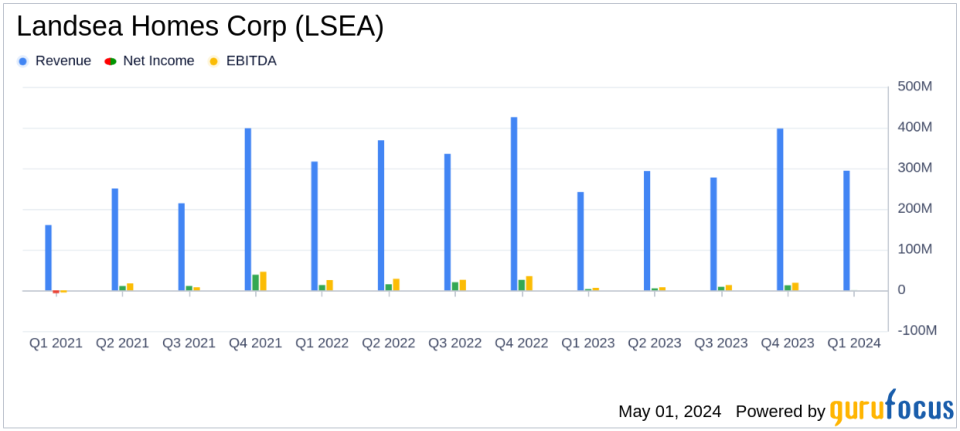

Revenue: Reported at $294.0 million for Q1 2024, marking a 22% increase year-over-year, surpassing the estimated $279.86 million.

-

Net Income: Achieved $0.2 million, significantly below the estimated $0.70 million.

-

Earnings Per Share (EPS): Recorded at $0.01 per share, falling short of the estimated $0.04 per share.

-

Adjusted EBITDA: Reached $17.0 million, indicating a growth from $16.2 million in the same quarter the previous year.

-

Home Deliveries: Increased by 7% to 505 homes, with an average selling price of $579,000, up 14% from the previous year.

-

Net New Home Orders: Grew by 23% to 612 homes, with the average selling price slightly below last year at $558,000.

-

Share Repurchase: Approximately 534,000 shares of common stock were repurchased for $6.4 million during the quarter.

On May 1, 2024, Landsea Homes Corp (NASDAQ:LSEA) announced its first quarter results for the year, revealing significant achievements and challenges. The company released its 8-K filing which detailed a mixed financial performance compared to analyst expectations. Landsea Homes, a prominent homebuilder known for its sustainable master-planned communities, reported a total revenue of $294.0 million, surpassing the estimated $279.86 million. However, earnings per share (EPS) stood at $0.01, significantly below the anticipated $0.04.

Company Overview

Landsea Homes operates primarily in Arizona, California, Florida, Metro New York, and Texas, with a significant portion of its revenue generated from home sales in Florida. The company’s strategy includes designing and constructing homes that cater to the preferences of modern homeowners, emphasizing sustainability and smart home technology.

Performance Highlights and Challenges

The first quarter saw Landsea Homes achieving a 22% increase in revenue year-over-year, driven by a 7% rise in homes closed and a notable 14% increase in average sales price to $579,000. Net new home orders grew by 23% to 612 homes. Despite these gains, the company faced challenges, including a lower net income of $0.2 million compared to $3.2 million in the prior year, primarily due to increased sales discounts and incentives which impacted margins.

CEO John Ho highlighted the strong demand trends and the strategic moves made to enhance financial stability, such as equity offerings and senior notes placement. However, he also noted the impact of rising interest rates on affordability, which the company aims to mitigate through various financing incentives.

Financial Details and Metrics

Landsea Homes reported an adjusted EBITDA of $17.0 million and a book value per share of $17.92. The company repurchased approximately 534,000 shares for $6.4 million, reflecting confidence in its business strategy. The balance sheet showed a total liquidity of $364.1 million, with a slight increase in total debt to $585.2 million from the previous quarter.

Looking ahead, Landsea Homes anticipates delivering between 600 to 650 new homes in the second quarter of 2024, with expected home sales gross margin between 15% and 16%. For the full year, the company expects to deliver between 2,500 to 2,900 new homes.

Investor and Analyst Perspectives

While the revenue figures exceeded expectations, the miss on EPS and the reduced net income highlight areas of concern, particularly relating to cost management and profit margins. Investors and analysts will likely focus on the company’s ability to maintain sales growth while managing costs and navigating the challenges posed by economic conditions and interest rate fluctuations.

Overall, Landsea Homes’ first quarter results depict a company with strong sales performance but facing margin pressures. The strategic initiatives undertaken to strengthen the balance sheet and enhance shareholder value through stock repurchases are positive steps, but the company must continue to adapt to the dynamic market conditions to sustain its growth trajectory.

For detailed financial analysis and future updates on Landsea Homes Corp (NASDAQ:LSEA), stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Landsea Homes Corp for further details.

This article first appeared on GuruFocus.