-

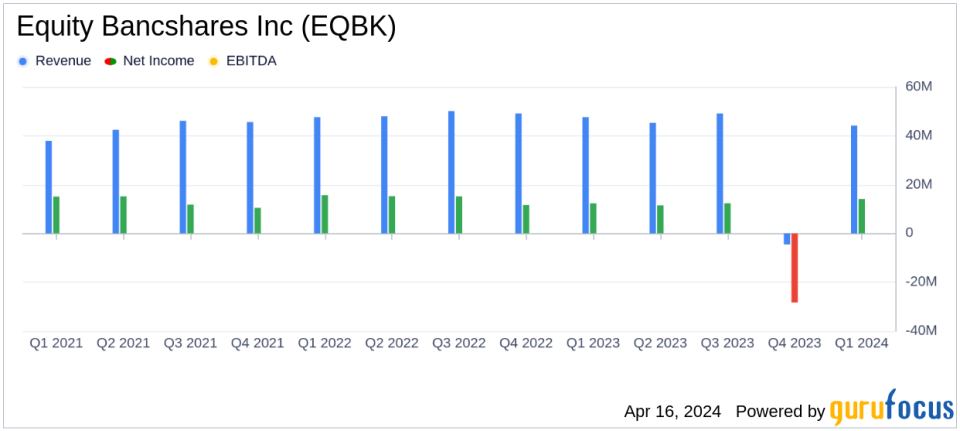

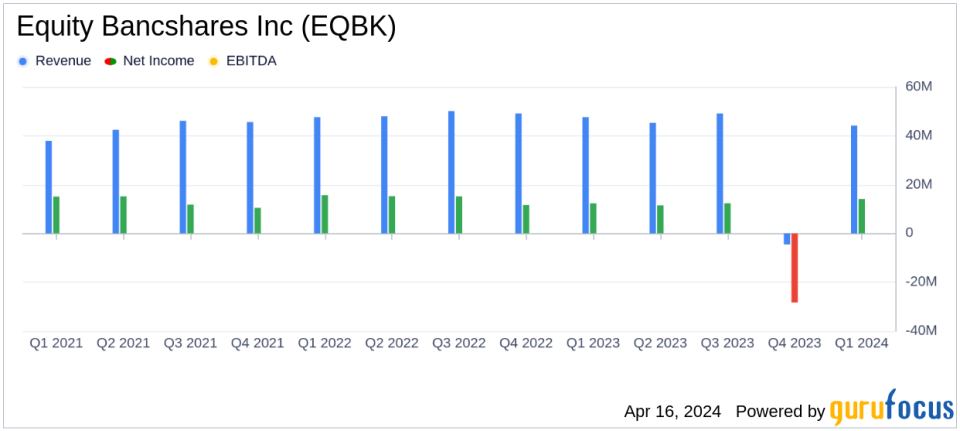

Net Income: Reported at $14.1 million, with earnings per diluted share of $0.90, surpassing the estimated $0.85 EPS.

-

Revenue: Net interest income reached a record $44.2 million, driven by asset growth and margin improvements.

-

Merger and Acquisition: Successfully completed the acquisition of Rockhold Bancorp, significantly expanding its Missouri franchise.

-

Asset and Loan Growth: Total assets increased to $5.20 billion, with loans held for investment rising by $149.3 million, influenced by the recent acquisition.

-

Capital and Liquidity: Maintained strong capital levels with a common equity tier 1 capital ratio of 11.1%.

Equity Bancshares Inc (NYSE:EQBK), a prominent bank holding company, disclosed its first quarter results on April 16, 2024, highlighting a period of significant strategic developments and financial growth. The complete details of the earnings can be viewed in their 8-K filing.

Company Overview

Based in Wichita, Kansas, Equity Bancshares Inc operates primarily through its subsidiary, Equity Bank. It offers a diverse range of financial products and services including commercial and consumer banking, mortgage loans, and wealth management. The company’s revenue streams are predominantly derived from interest income on loans and investments, complemented by non-interest income from service charges, fees, and other banking services.

Financial Highlights and Strategic Achievements

For the quarter ended March 31, 2024, Equity Bancshares reported a net income of $14.1 million, or $0.90 per diluted share, which notably exceeds the analyst’s EPS estimate of $0.85. This performance marks a robust start to the year, reflecting both organic growth and benefits realized from strategic acquisitions. Notably, the merger with Rockhold Bancorp was completed, adding $118.7 million in loans and $349.6 million in deposits to the company’s portfolio.

The company achieved a record net interest income of $44.2 million for the quarter, driven by an increase in average assets and an improved net interest margin (NIM) of 3.75%. This growth is attributed to the re-positioning of the banks bond portfolio and the accretive impact of recent acquisitions. Moreover, the strategic acquisition activities not only expanded Equitys geographical footprint but also enhanced its financial positioning through a gain on acquisition of $1.2 million.

Operational and Financial Challenges

Despite the positive outcomes, the company faced challenges including increased provisions for credit losses totaling $1.0 million, primarily due to the establishment of reserves on newly acquired loans. Additionally, non-interest expenses rose to $37.1 million, reflecting merger-related costs and the integration of new operations.

Future Outlook and Strategic Direction

Looking ahead, Equity Bancshares is well-positioned for continued growth. The company’s leadership, under Chairman and CEO Brad S. Elliott, remains focused on leveraging strategic opportunities to enhance shareholder value. The ongoing integration of acquired entities and potential future acquisitions are expected to further strengthen the companys market presence and financial performance.

Equity Bancshares continues to maintain a strong capital position with high levels of liquidity and robust credit quality, positioning it favorably for future growth and stability in the dynamic banking sector.

For further insights and detailed financial analysis, stakeholders and interested investors are encouraged to refer to the full earnings release and supplementary financial data provided by Equity Bancshares Inc.

Explore the complete 8-K earnings release (here) from Equity Bancshares Inc for further details.

This article first appeared on GuruFocus.