-

Net Sales: Reached $933 million, up 4% year-over-year, surpassing estimates of $839.69 million.

-

Net Income: Grew 16% to $35 million, exceeding the estimated $28.73 million.

-

Earnings Per Share (EPS): Reported at $1.59, up 18% from the previous year, surpassing the estimated $1.32.

-

Operating Margin: Increased by 20 basis points to 6.4%, reflecting improved operational efficiency.

-

Adjusted EBITDA: Rose 14% to $111 million; adjusted EBITDA margin expanded by 110 basis points to 11.9%.

-

Cash Flow: Operating cash flow improved significantly to $35 million, compared to a cash use of $1 million in the same period last year.

-

Acquisitions: Completed the acquisition of Sportech, LLC, marking a significant expansion into the powersports industry.

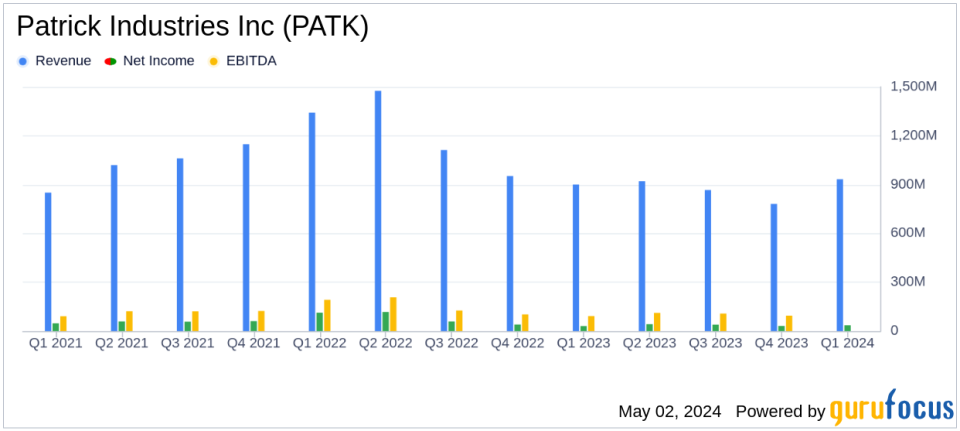

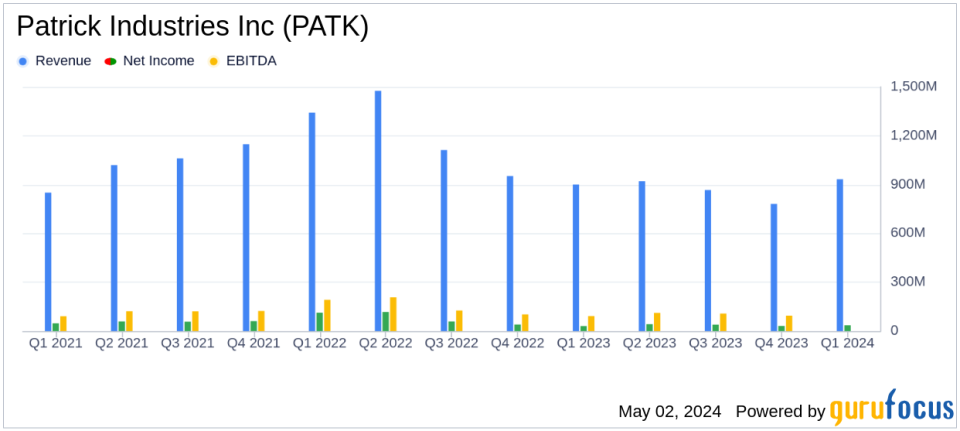

Patrick Industries Inc (NASDAQ:PATK), a prominent manufacturer and distributor of building products for the recreational vehicle (RV) and manufactured housing markets, released its 8-K filing on May 2, 2024, revealing a robust financial performance for the first quarter of 2024. The company reported a significant increase in net sales and earnings, outperforming analyst estimates and demonstrating effective strategic growth initiatives.

Company Overview

Patrick Industries, headquartered in Elkhart, Indiana, operates primarily in two segments: manufacturing and distribution. The company’s manufacturing segment, which contributes the majority of its revenue, offers a wide range of products including furniture, cabinets, and countertops primarily for the RV and manufactured housing industries. The distribution segment provides essential components like electrical and plumbing products. One of Patrick’s RV customers accounts for a significant portion of its revenue, highlighting the importance of the RV market to its business model.

Financial Highlights and Performance

For Q1 2024, Patrick Industries reported net sales of $933 million, a 4% increase from $900 million in the same quarter the previous year. This growth was primarily fueled by a 15% increase in RV revenue and a 5% rise in housing revenue, alongside the strategic acquisition of Sportech, LLC. This acquisition marks the company’s largest to date and significantly bolsters its market position in the powersports industry.

Net income for the quarter stood at $35 million, up 16% from $30 million in Q1 2023, with diluted earnings per share (EPS) increasing 18% to $1.59, surpassing the estimated EPS of $1.32. Adjusted EBITDA also saw a notable rise, increasing 14% to $111 million, reflecting an improved EBITDA margin of 11.9%.

Operational and Strategic Developments

Patrick Industries’ operational success in the quarter can be attributed to its disciplined management and strategic growth through acquisitions. The acquisition of Sportech not only diversifies Patrick’s product offerings but also strengthens its foothold in the outdoor enthusiast market. Additionally, the company benefited from higher fixed cost absorption within its RV businesses and ongoing cost-saving initiatives.

The company’s balance sheet remains robust, with net leverage at 2.8x. Cash flow from operations was significantly positive at $35 million, compared to a cash use of $1 million in the prior year, driven by a substantial reduction in working capital utilization and an increase in net income.

Market Sector Performance

The RV sector, representing 45% of total revenue, saw a revenue increase of 15% to $421 million. However, the marine sector experienced a 35% decline in revenue to $155 million, reflecting a decrease in wholesale powerboat industry unit shipments. The housing sector, comprising manufactured housing and industrial components, reported a 5% revenue increase to $275 million.

Looking Ahead

CEO Andy Nemeth expressed optimism about the company’s future, citing the first quarter’s performance as evidence of Patrick’s resilience and strategic positioning. The company anticipates continued growth in the RV and manufactured housing markets and expects stabilization in the marine sector in the latter half of 2024.

As Patrick Industries continues to navigate through market fluctuations with a strong focus on innovation and customer service, it remains well-positioned to capitalize on future growth opportunities in the outdoor enthusiast and housing markets.

Conclusion

Patrick Industries’ first-quarter results for 2024 reflect a company that is not only managing to navigate challenges but is also strategically positioning itself for sustained long-term growth. With a solid performance that surpasses analyst expectations, Patrick Industries is reinforcing its status as a key player in the industries it serves.

Explore the complete 8-K earnings release (here) from Patrick Industries Inc for further details.

This article first appeared on GuruFocus.