-

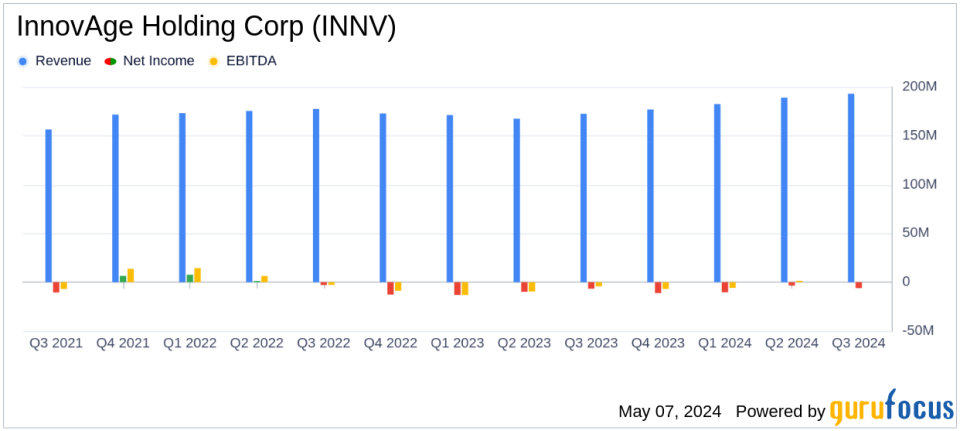

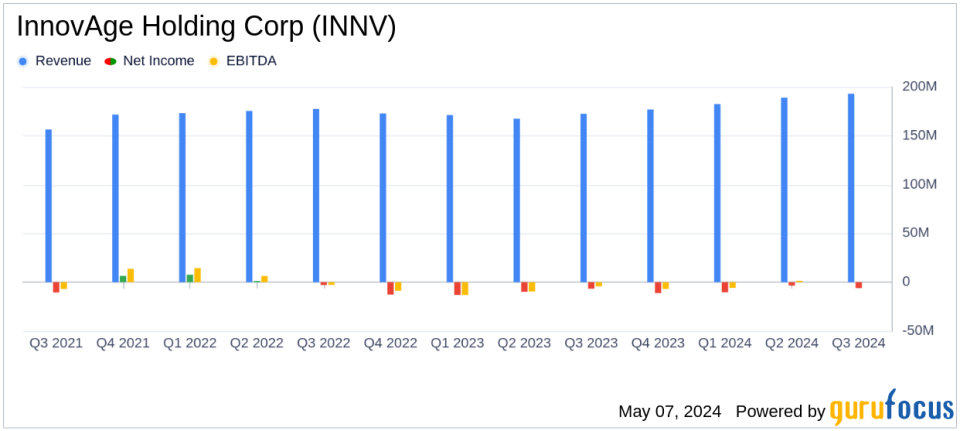

Revenue: Reported at $193.1 million for the fiscal third quarter, up by 11.9% year-over-year, exceeding the estimate of $188.25 million.

-

Net Loss: Recorded at $6.2 million, an improvement from a net loss of $7.3 million in the same quarter last year, but still did not meet the estimated net loss of $4.55 million.

-

Earnings Per Share (EPS): Reported a loss of $0.04 per share, which did not meet the estimated loss of $0.03 per share.

-

Adjusted EBITDA: Reached $3.6 million, a slight decrease from $3.8 million in the prior year’s quarter, with a margin of 1.9%, down from 2.2%.

-

Center-level Contribution Margin: Increased by 18.1% to $34.0 million, with the margin as a percentage of revenue improving to 17.6% from 16.7%.

-

Participant Census: Grew to approximately 6,820 participants, up from 6,310 in the previous year’s quarter.

-

Liquidity Position: Ended the quarter with $54.1 million in cash and cash equivalents, plus $45.2 million in short-term investments.

On May 7, 2024, InnovAge Holding Corp (NASDAQ:INNV), a leader in senior healthcare services, disclosed its financial outcomes for the fiscal third quarter ended March 31, 2024, through an 8-K filing. The company, known for its Program of All-inclusive Care for the Elderly (PACE), reported a net loss but showed significant improvement in revenue and operational margins compared to the previous year.

Company Overview

InnovAge Holding Corp operates a healthcare delivery platform focused on providing capitated care to high-cost, dual-eligible seniors. The company’s model aims to improve care quality while reducing unnecessary hospital and nursing home use. InnovAge primarily generates revenue from its PACE segment, which has shown robust performance in the reported quarter.

Financial Performance Highlights

In the fiscal third quarter of 2024, InnovAge achieved total revenues of $193.1 million, marking an 11.9% increase from $172.5 million in the same quarter of the previous year. This growth is attributed to an expanded census of approximately 6,820 participants, up from 6,310 in the prior year. Despite this revenue growth, the company faced a net loss of $6.2 million, though this was an improvement over the $7.3 million loss reported in the third quarter of fiscal 2023.

The net loss margin improved to 3.2% from 4.2%, reflecting enhanced operational efficiency. The loss per share narrowed to $0.04 from $0.05 year-over-year. Additionally, the Center-level Contribution Margin increased by 18.1% to $34.0 million, demonstrating effective cost management and operational improvements.

Balance Sheet and Cash Flow Insights

As of March 31, 2024, InnovAge reported $54.1 million in cash and cash equivalents, alongside $45.2 million in short-term investments. The company’s total assets amounted to $527.4 million. The balance sheet also showed a long-term debt of $62.3 million, reflecting ongoing financial commitments.

The cash flow statements highlight a challenging operational environment, with net cash used in operating activities totaling $38.8 million for the nine months ended March 31, 2024. This figure contrasts with a net cash provided by operating activities of $7.1 million in the same period last year, underscoring increased operational expenditures and adjustments in working capital management.

Strategic Initiatives and Outlook

Patrick Blair, President and CEO of InnovAge, commented on the company’s strategic initiatives, stating,

The portfolio of initiatives that weve launched over the past two years is creating tangible impact. We continue to see ongoing performance improvement in our operations which is driving greater stability in our financial results and confidence in our ability to deliver high-quality care.”

This reflects the company’s focus on enhancing operational efficiencies and participant care quality.

For the full fiscal year 2024, InnovAge has reiterated its financial guidance, projecting total revenues between $725 million and $775 million, and adjusted EBITDA between $12 million and $18 million. This guidance reflects the management’s confidence in maintaining operational momentum and financial stability.

Conclusion

While InnovAge faces challenges typical of the healthcare sector, including managing high operational costs and navigating complex regulatory environments, its latest financial results indicate effective management strategies and a resilient business model. The company’s ability to increase revenue and improve operational margins, despite a net loss, suggests potential for future profitability and stability.

Investors and stakeholders will likely watch closely as InnovAge continues to execute its strategic initiatives and expand its participant base, aiming for sustained growth and improved financial health in the competitive healthcare market.

Explore the complete 8-K earnings release (here) from InnovAge Holding Corp for further details.

This article first appeared on GuruFocus.