-

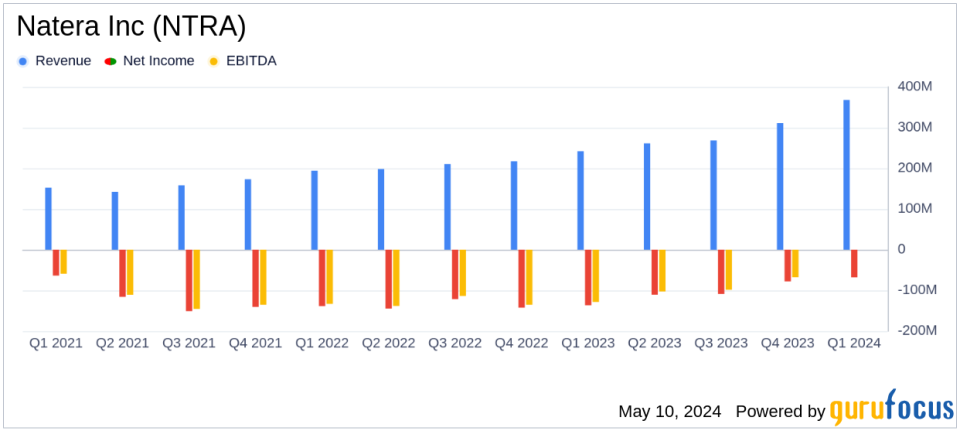

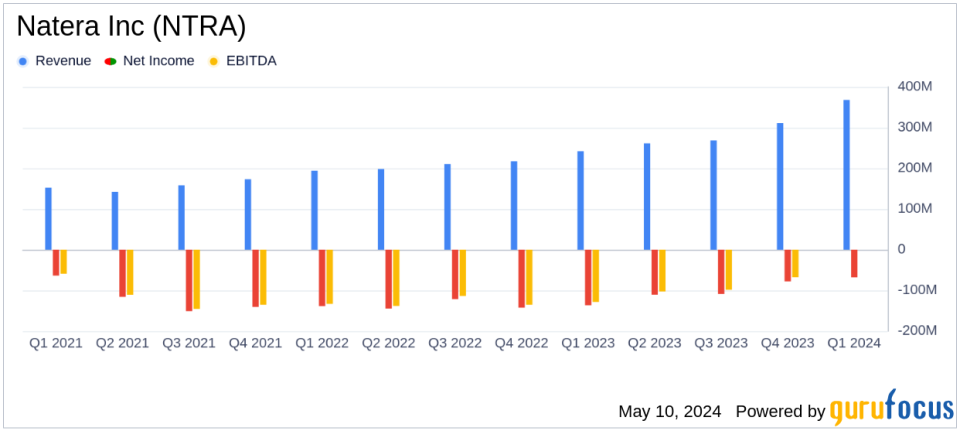

Revenue: $367.7M for Q1 2024, a 52.1% increase year-over-year, surpassing the estimate of $316.31M.

-

Net Loss: Reported a net loss of $67.6M, or ($0.56) per diluted share, an improvement from a net loss of $136.9M year-over-year, and below the estimated loss of $84.61M.

-

Earnings Per Share: Reported EPS of ($0.56), better than the estimated EPS of ($0.71).

-

Gross Margin: Increased to 56.7% in Q1 2024 from 38.7% in Q1 2023, indicating improved profitability.

-

Test Volume: Processed approximately 735,800 tests, up from 626,200 in the previous year, reflecting a 16.5% increase in tests reported.

-

Operating Expenses: Grew to $282.9M, up 22% year-over-year, driven by expansion in headcount and increased consulting and legal expenses.

-

Cash Position: Held approximately $882.9M in cash and equivalents as of March 31, 2024, showing strong liquidity.

Natera Inc (NASDAQ:NTRA), a pioneer in cell-free DNA and genetic testing, disclosed its financial outcomes for the first quarter ended March 31, 2024, through an 8-K filing. The company reported a remarkable year-over-year revenue increase, substantially exceeding analyst expectations for the quarter.

Company Overview: Based in Austin, Texas, Natera Inc specializes in advanced genetic testing and diagnostics, focusing on critical areas such as oncology, women’s health, and organ health. Its key products include the Panorama Non-Invasive Prenatal Test (NIPT), Horizon Carrier Screening (HCS), Signatera MRD test, and Prospera transplant rejection assessment.

Financial Performance Insights

For Q1 2024, Natera reported revenues of $367.7 million, a significant increase of 52.1% from $241.8 million in the same period last year. This growth was primarily fueled by a 53.4% increase in product revenues, which rose to $364.7 million. The company processed approximately 735,800 tests during the quarter, marking a substantial increase from the 626,200 tests processed in Q1 2023.

The gross profit for the quarter stood at $208.6 million, with a gross margin of 56.7%, compared to $93.6 million and a margin of 38.7% in the previous year. This improvement in gross margin was attributed to higher revenues and ongoing reductions in the cost of goods sold.

Despite these gains, Natera reported a net loss of $67.6 million, or ($0.56) per diluted share, which is an improvement from a net loss of $136.9 million, or ($1.23) per diluted share, in Q1 2023. The company’s operating expenses were $282.9 million, up 22.0% year-over-year, driven by increased headcount and higher consulting and legal costs.

Balance Sheet and Future Outlook

As of March 31, 2024, Natera held approximately $882.9 million in cash and investments, slightly up from $879.0 million at the end of 2023. The company’s total outstanding debt stood at $363.7 million. Looking ahead, Natera anticipates 2024 total revenues to be between $1.42 billion and $1.45 billion, with a gross margin projected to be between 53% and 55%.

Operational and Strategic Developments

Steve Chapman, CEO of Natera, highlighted the company’s robust start to the year, noting significant volume and revenue growth. He emphasized the strategic launch of new products in womens health and the publication of influential data in oncology and organ health, which are expected to drive future growth.

Natera remains committed to enhancing disease management through its innovative testing solutions, aiming to integrate personalized genetic testing into standard care practices for better health outcomes.

Conclusion

Overall, Natera Inc’s first quarter of 2024 demonstrated strong financial and operational performance, with significant improvements in revenue and test volumes. The company’s strategic initiatives and product launches are set to further solidify its position in the genetic testing market, despite the ongoing challenges of managing operational costs and minimizing losses.

For detailed financial figures and future updates, investors and interested parties are encouraged to refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Natera Inc for further details.

This article first appeared on GuruFocus.