-

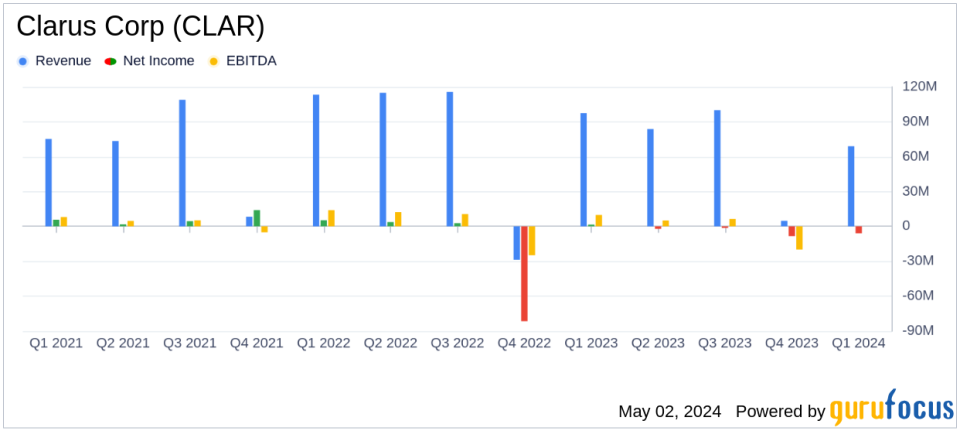

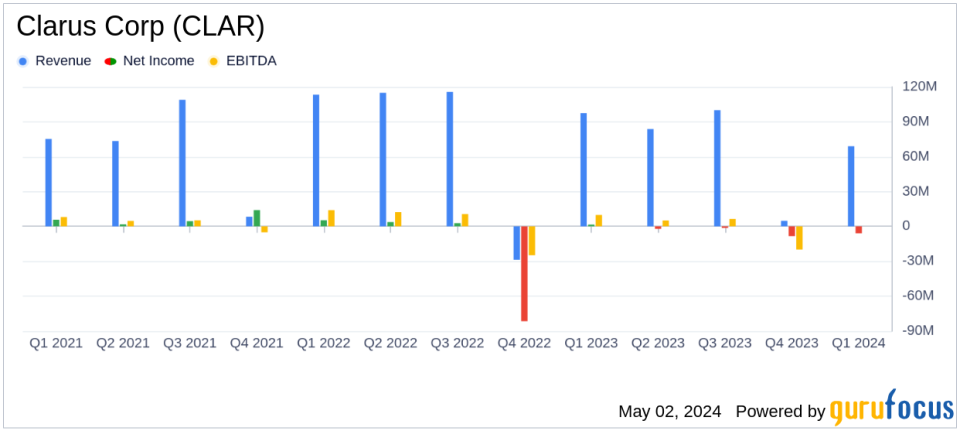

Revenue: Reported at $69.3 million, down slightly from $70.3 million in the previous year, beating the estimated $64.33 million.

-

Net Loss: Increased to $6.5 million from $2.0 million year-over-year, significantly above the estimated net loss of $1.46 million.

-

Earnings Per Share (EPS): Recorded a loss of $0.17 per diluted share, deeper than the estimated loss of $0.01 per share.

-

Gross Margin: Slightly decreased to 35.9% from 36.3% in the year-ago quarter, with adjusted gross margin improving to 36.9%

-

Adventure Segment Sales: Grew by 27% to $22.3 million, driven by strong OEM customer demand and new product launches.

-

Free Cash Flow: Experienced a significant outflow of $18.3 million compared to a positive flow of $1.7 million in the prior year quarter.

-

Full Year Guidance: Reaffirmed, expecting annual sales between $270 million to $280 million and adjusted EBITDA of approximately $16 million to $18 million.

On May 2, 2024, Clarus Corp (NASDAQ:CLAR), a leading designer and distributor of outdoor equipment and lifestyle products, disclosed its financial outcomes for the first quarter ended March 31, 2024, through its 8-K filing. The report highlighted a slight decrease in sales and a significant increase in losses from continuing operations, although the company managed to reaffirm its full-year guidance.

Overview of Financial Performance

Clarus Corp reported a decrease in total sales to $69.3 million in Q1 2024 from $70.3 million in the same quarter the previous year. This decline was primarily due to weaknesses in the European wholesale market within the Outdoor segment, partially offset by robust performance in the Adventure segment, which saw a 27% increase in sales driven by strong OEM customer demand and the impact of the TRED Outdoors acquisition.

The company’s gross margin slightly declined to 35.9% from 36.3% year-over-year, affected by promotional pricing and unfavorable channel mix. Adjusted gross margin, however, improved to 36.9% from 36.3%, reflecting effective cost management strategies.

Operating expenses decreased to $28.2 million from $29.4 million, thanks to cost reduction initiatives in the Outdoor segment. However, the loss from continuing operations widened significantly to $6.5 million, or $(0.17) per diluted share, compared to a loss of $2.0 million, or $(0.05) per diluted share in the year-ago quarter. This was influenced by $3.0 million in charges related to legal costs and regulatory matters, and $0.7 million in PFAS inventory reserve.

Strategic and Operational Highlights

Warren Kanders, Clarus Executive Chairman, emphasized the company’s strategic efforts in simplifying operations and launching new products. Despite the challenging conditions in Europe and global markets, the company is focusing on enhancing product margins and expanding its market presence, particularly in the Adventure segment.

The company also successfully reduced its apparel inventory by nearly 38% year-over-year, signaling effective inventory management in the Outdoor segment. These efforts are part of Clarus’ broader strategy to transition to a more focused, ESG-friendly outdoor business.

Financial Position and Outlook

Clarus Corp ended the quarter with $47.5 million in cash, a significant increase from $11.3 million at the end of 2023. The substantial improvement in liquidity was partially due to the sale of its Precision Sport segment, which added $40.6 million to the discontinued operations.

For the full year 2024, Clarus continues to project sales between $270 million to $280 million and an adjusted EBITDA of approximately $16 million to $18 million. The company also anticipates capital expenditures to range between $4 million to $5 million and expects free cash flow to be between $18 million to $20 million.

Conclusion

Despite facing several challenges, including market softness in Europe and increased operational costs, Clarus Corp is strategically navigating through these headwinds. The reaffirmation of its full-year guidance reflects management’s confidence in their strategic initiatives and operational adjustments. Investors and stakeholders will likely watch closely how these strategies unfold in the upcoming quarters.

For further details, Clarus Corp will hold a conference call to discuss the quarterly results and provide more insights into its operational strategies and financial planning.

Explore the complete 8-K earnings release (here) from Clarus Corp for further details.

This article first appeared on GuruFocus.