-

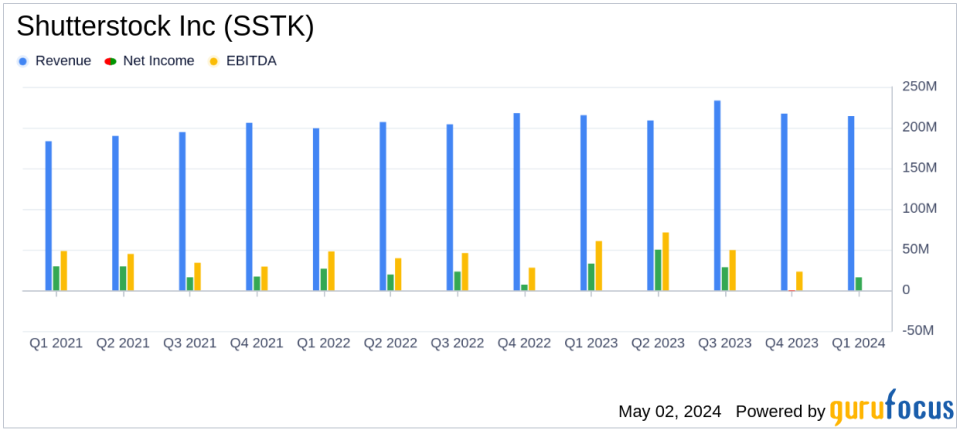

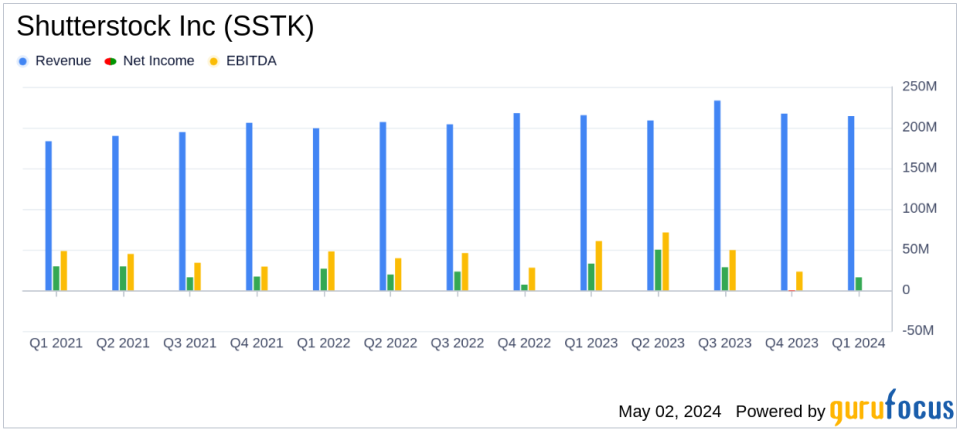

Revenue: Reported at $214.3 million for Q1 2024, slightly above the estimate of $208.52 million.

-

Net Income: Totaled $16.1 million, significantly below the estimated $35.70 million.

-

Earnings Per Share (EPS): Achieved $0.45, well below the estimated $0.99.

-

Adjusted EBITDA: Reached $56.0 million, a decrease of 20% year-over-year, indicating rising operational costs.

-

Net Income Margin: Dropped to 7.5% from 15.3% in the previous year, reflecting higher costs and expenses.

-

Adjusted Free Cash Flow: Declined sharply to $11.2 million from $50.8 million in Q1 2023, due to increased cash used in operations and investments.

-

Subscriber Base: Decreased to 499,000 from 559,000 year-over-year, highlighting challenges in customer retention and acquisition.

On May 2, 2024, Shutterstock Inc (NYSE:SSTK) disclosed its first-quarter financial performance through its 8-K filing, revealing a challenging quarter with stagnant revenue growth and a significant drop in net income. The company, a leading global provider of digital content including images, footage, and music, reported a revenue of $214.3 million, aligning with the previous year’s figures but falling short of the analyst’s expectation of $208.52 million.

Despite the revenue consistency, net income for Q1 2024 experienced a sharp decline to $16.1 million from $32.8 million in Q1 2023, significantly below the estimated $35.70 million. This decline was largely attributed to increased operating expenses, including costs associated with the acquisition of Envato Pty Ltd., and higher marketing expenses. The earnings per share (EPS) stood at $0.45, a stark contrast to the estimated $0.99, reflecting the unforeseen costs impacting profitability.

Strategic Acquisitions and Market Expansion

Shutterstock’s CEO, Paul Hennessy, highlighted the acquisition of Envato as a strategic expansion to enhance Shutterstock’s product offerings and accelerate its long-term goals. The acquisition, valued at approximately $245 million, is expected to close in Q3 2024, subject to regulatory approvals. This move is anticipated to strengthen Shutterstock’s position in the digital content market by broadening its reach and enhancing its content library.

Financial Health and Operational Metrics

The company’s balance sheet shows a decrease in cash and cash equivalents, down to $71.8 million from $100.5 million at the end of 2023. This reduction is primarily due to cash used in financing activities, including dividends and tax obligations related to employee stock compensation, and investing activities related to acquisitions and capital expenditures.

Key operational metrics also depicted mixed signals with a decrease in total subscribers from 559,000 in Q1 2023 to 499,000 in Q1 2024, and a decline in subscriber revenue. However, average revenue per customer showed an increase, suggesting higher revenue generation from existing customers.

Outlook and Forward Guidance

Looking ahead, Shutterstock has revised its full-year 2024 guidance upwards, although specific figures were not disclosed in the earnings release. This optimistic outlook is likely based on expected synergies from recent acquisitions and an anticipated recovery in customer acquisition trends.

Conclusion

While Shutterstock faces short-term challenges, particularly with its profitability metrics, the strategic acquisitions and stable revenue point to a potentially stronger performance in the future. Investors and stakeholders will likely keep a close watch on how effectively the company integrates its new assets and capitalizes on emerging market opportunities.

For detailed financial figures and further information, refer to Shutterstock’s investor relations website.

Explore the complete 8-K earnings release (here) from Shutterstock Inc for further details.

This article first appeared on GuruFocus.