-

Revenue: Reported at $3.7 billion, marking an 11% increase year-over-year, aligning closely with estimates of $3.769 billion.

-

Net Income: Reached $158 million, falling significantly below the estimated $252.33 million.

-

Earnings Per Share (EPS): Recorded at $0.59, substantially below the estimated $0.95.

-

Free Cash Flow: Achieved $187 million, showcasing strong liquidity despite operational challenges.

-

Dividend: Announced a quarterly dividend of $0.30 per share, reinforcing shareholder returns.

-

Stock Repurchase: Invested $30 million in repurchasing shares, demonstrating confidence in the company’s valuation.

-

Strategic Divestitures: Continued rationalization of operations with divestitures in Slovenia and planned divestiture in Bosnia.

LKQ Corp (NASDAQ:LKQ) released its 8-K filing on April 23, 2024, revealing mixed first-quarter results. The global distributor of non-OEM automotive parts reported a significant revenue increase but faced challenges leading to a decline in earnings per share (EPS).

LKQ Corp, established in 1998, has evolved from a consolidator of auto salvage operations in the United States to a major player in the distribution of new mechanical and collision parts, specialty auto equipment, and remanufactured and recycled parts across Europe and North America. The company operates around 1,700 facilities globally.

Financial Performance Overview

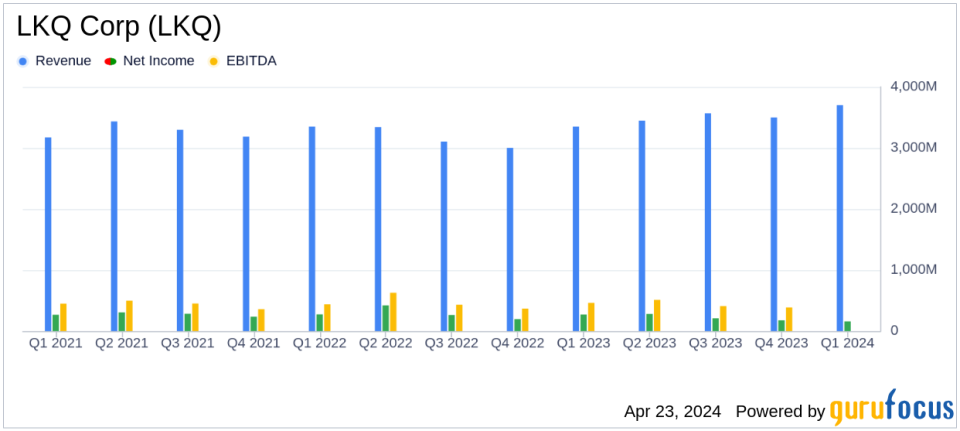

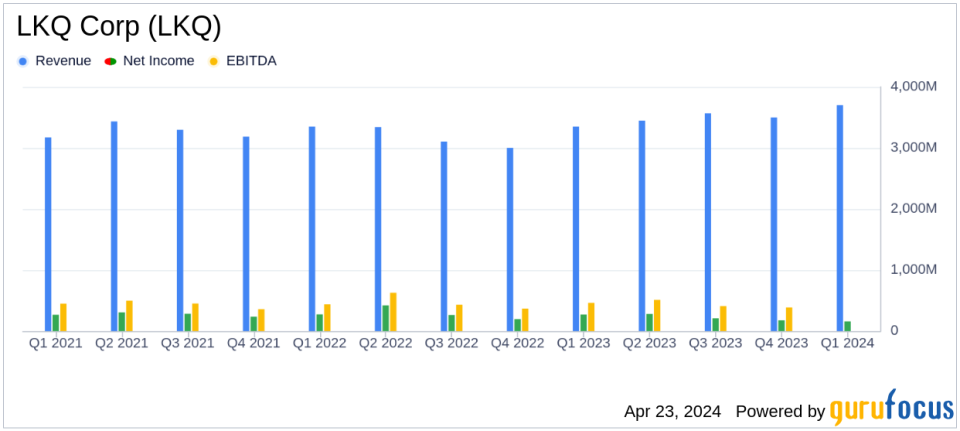

For Q1 2024, LKQ reported revenue of $3.7 billion, marking an 11% increase from the $3.3 billion posted in the same period last year. This growth was primarily driven by acquisitions and favorable foreign exchange rates, partially offset by a slight decline in organic revenue. Despite this, the company’s net income saw a substantial decline to $158 million from $270 million in Q1 2023, with diluted EPS dropping from $1.01 to $0.59.

Adjusted for non-recurring items, diluted EPS was $0.82, a decrease from $1.04 year-over-year and below the analyst estimate of $0.95. This decline in profitability was attributed to reduced demand in the Wholesale North America segment, largely due to unusually warm weather impacting repairable claims.

Operational Highlights and Strategic Adjustments

LKQ’s operational cash flow remained strong at $253 million, with free cash flow reaching $187 million. The company continued its shareholder return programs, repurchasing $30 million of its shares and declaring a quarterly dividend of $0.30 per share.

The company also faced operational challenges, particularly in its North American segment, leading to the consolidation of 65 branches in its FinishMaster network. This rationalization is part of a broader strategy to enhance efficiency and uncover additional synergies, which have been revised upwards from $55 million to $65 million.

Furthermore, LKQ completed a significant financial maneuver by issuing 750 million of 4.125% senior unsecured notes, using the proceeds to repay existing indebtedness and related costs.

Looking Ahead

Despite the first quarter’s setbacks, LKQ’s management remains confident in their strategic initiatives and maintains their full-year guidance for adjusted EPS and free cash flow, albeit with a revised lower organic revenue growth forecast.

As LKQ navigates through these challenges, the company’s ability to adapt to market conditions while continuing to generate robust cash flows will be crucial for sustaining long-term growth and profitability.

Investor Implications

The mixed financial results highlight the importance of LKQ’s strategic adjustments in response to market dynamics. Investors should monitor the company’s ability to stabilize its North American operations and the impact of its European growth on overall performance. The ongoing share repurchase and dividend payments reflect a commitment to shareholder returns, supporting investment attractiveness amidst current challenges.

For detailed insights and further information, investors are encouraged to review the full earnings report and stay tuned for updates on LKQ’s strategic initiatives and financial performance.

Explore the complete 8-K earnings release (here) from LKQ Corp for further details.

This article first appeared on GuruFocus.