-

Service Revenue: Reported at $266.2 million for Q1 2024, falling short of the estimated $273.69 million.

-

On-net Revenue: Reached $138.6 million, showing a modest increase of 0.4% from the previous quarter.

-

Off-net Revenue: Declined to $118.2 million, a decrease of 4.4% from the previous quarter.

-

GAAP Gross Margin: Dropped to 9.9% in Q1 2024 from 10.9% in the previous quarter and compared to 45.4% year-over-year.

-

Non-GAAP Gross Margin: Improved slightly to 36.7% from 36.0% in the previous quarter.

-

Net Income (Loss) per Share: Reported a loss of $1.38 per share, significantly below the estimated loss of $1.04 per share.

-

Quarterly Dividend: Increased to $0.975 per share, payable on June 7, 2024, marking a 1.0% increase from the previous quarter.

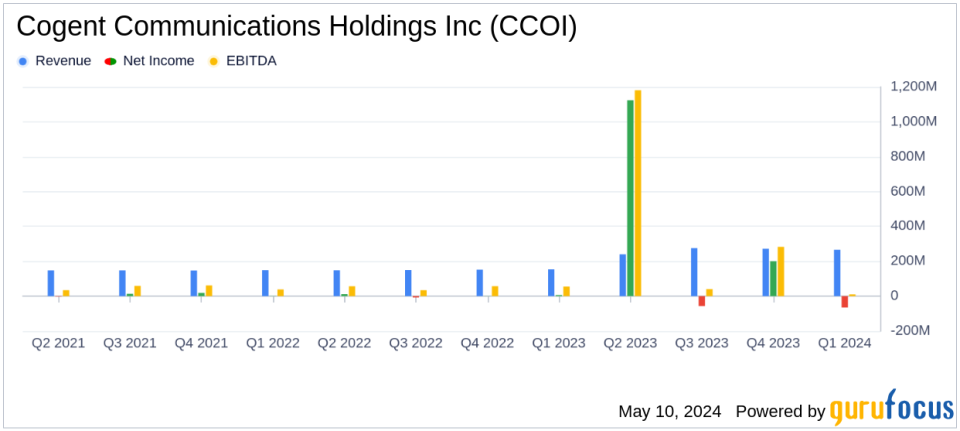

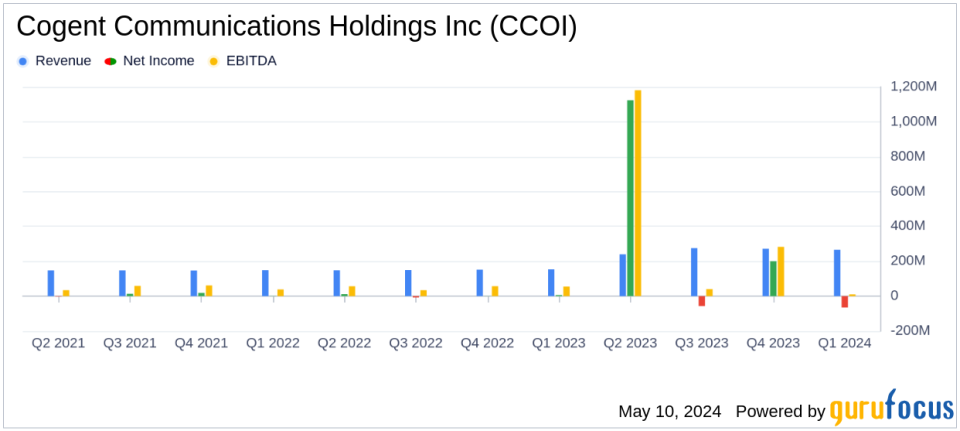

On May 9, 2024, Cogent Communications Holdings Inc (NASDAQ:CCOI) disclosed its first quarter results for 2024, revealing a mix of growth and challenges. The company reported a service revenue of $266.2 million, marking a 73.3% increase from the same quarter last year but a 2.2% decrease from the previous quarter. This performance was below the analyst’s expectation of $273.69 million. The detailed earnings can be viewed in Cogent’s 8-K filing.

Company Overview

As a major broadband provider, Cogent Communications handles over a fifth of the world’s internet traffic. It offers dedicated internet access and virtual private networking primarily to corporate customers in North America, which constitute more than half of its revenue. The remaining revenue comes from netcentric customers, including internet service providers and content providers, both domestically and internationally.

Financial Performance and Challenges

Despite the impressive year-over-year revenue growth, Cogent faced a quarterly revenue decline. The company’s GAAP gross profit significantly decreased by 62.3% year-over-year to $26.3 million, with the GAAP gross margin also dropping to 9.9%. This decline reflects ongoing operational challenges, including increased network operations expenses and the impact of foreign exchange rates.

On the earnings front, Cogent reported a diluted net loss per share of $1.38, which was significantly off from the estimated earnings per share of -$1.04. This miss can be attributed to higher operational costs and expenses related to the Sprint acquisition.

Operational Highlights and Strategic Moves

The company’s operational metrics showed mixed results. Total customer connections decreased by 3.4% from the previous quarter, although there was a substantial increase of 36.4% from the year-ago period. The number of on-net buildings increased, indicating potential for expanded service coverage and customer base growth.

In strategic developments, Cogent increased its regular quarterly dividend to $0.975 per share, up from $0.965 in the previous quarter, reflecting a commitment to shareholder returns despite financial pressures.

Analysis of Financial Statements

Analysis of Cogent’s balance sheet and cash flow statements reveals a company with robust year-over-year growth but facing short-term liquidity challenges. Net cash provided by operating activities was $19.2 million, a recovery from a cash use of $48.7 million in the previous quarter but still lower than the $35.8 million from the year-ago period.

The company’s efforts to manage its debt and finance its operations are evident from its capital expenditure and dividend payout strategies. However, the ongoing costs from the Sprint acquisition and the residual impacts of the COVID-19 pandemic on the commercial real estate market pose significant risks to its corporate revenue streams.

Outlook and Forward-Looking Statements

Looking ahead, Cogent’s management remains cautiously optimistic. The gradual recovery in office occupancy rates and the integration of remote work applications by corporate clients are expected to drive future growth. Nonetheless, the uncertainty around the pace of return to office work and the potential for increased customer turnover underscores a challenging outlook for Cogent’s corporate revenue segments.

Investors and stakeholders are advised to monitor these developments closely, as they will play a critical role in shaping Cogent’s financial and operational trajectories in the upcoming quarters.

Explore the complete 8-K earnings release (here) from Cogent Communications Holdings Inc for further details.

This article first appeared on GuruFocus.