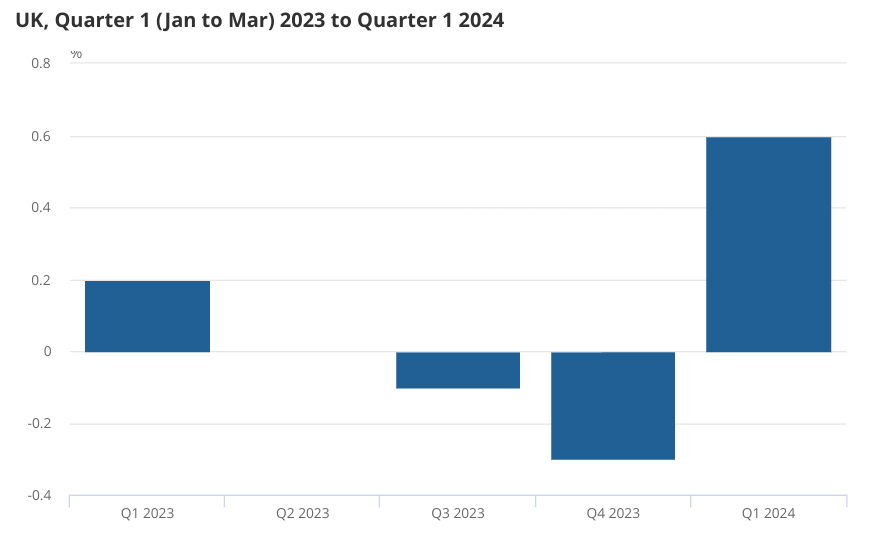

For the first time in what seems like forever, UK gross domestic product (GDP) grew at a very respectable clip in the first quarter of the year.

GDP expanded by 0.6 per cent, its best performance since the end of 2021. This was significantly better than economists’ expectations. Most had pencilled in a 0.4 per cent expansion.

The figures mean the UK grew at the joint-fastest rate in the G7, surpassing the US and tying with Canada.

More positively still, GDP per head —a good proxy for living standards — finally saw an improvement.

Prior to this quarter, GDP per head had been falling for seven consecutive quarters, the longest sustained fall since the 1950s. In the first quarter of this year, it grew 0.4 per cent.

Rob Wood, chief UK economist at Pantheon Macroeconomics, said the UK economy was “back with a bang”.

So, what’s been driving the strong performance?

The most important part of the British economy is household consumption. This increased 0.2 per cent in the first quarter after two consecutive quarters of decline.

The ONS pointed to higher spending on recreation, restaurants and hotels, as well as essential spending on water and fuel. In other words, many households have been more willing to splash the cash.

With inflation set to fall further and interest rate cuts in the offing, household spending is only likely to grow even more.

Looking on the output side, the UK’s all-important services sector grew for the first time since last year. Growth was broad-based with 11 out of the 14 subsectors notching an expansion.

The production sector—which includes manufacturing—also recorded a recovery, growing 0.8 per cent in the first quarter.

There are, however, a few reasons to be cautious.

First, the figures are somewhat flattered by being compared to the last quarter, when GDP shrunk.

“Growth in the rest of the year is unlikely to match the stonking pace of Q1, which was boosted by base effects,” Thomas Pugh, economist at RSM noted.

The quarterly figures were also flattered by an outsize contribution from net trade, which measures the balance of imports and exports. Exports fell in the quarter, generally not seen as a good thing, but at a much slower rate than imports, so the net contribution was positive.

And for all the excitement over today’s figures, it still leaves the economy just 0.2 per cent bigger than it was a year ago. GDP per head is actually 0.7 per cent lower than last year.

Still, the economy was never going to entirely fix itself in one quarter.

Survey data has suggested the strong growth rate seen at the beginning of the year has continued.

Confidence among businesses and consumers has also recovered strongly.

A range of forecasters, including the OECD, expect the UK to grow around 0.4 per cent this year. Those forecasts might be due an update after today’s figures.

A final point. With growth far exceeding expectations, there were some question marks over whether this would change the timing of the first interest rate cut.

Currently markets do not seem to think so and still put the odds of a June rate cut at about 50/50.

Ruth Gregory, deputy chief UK economist at Capital Economics, said: “We doubt the recovery will be strong enough to prevent inflation from falling further and the Bank from cutting rates”.