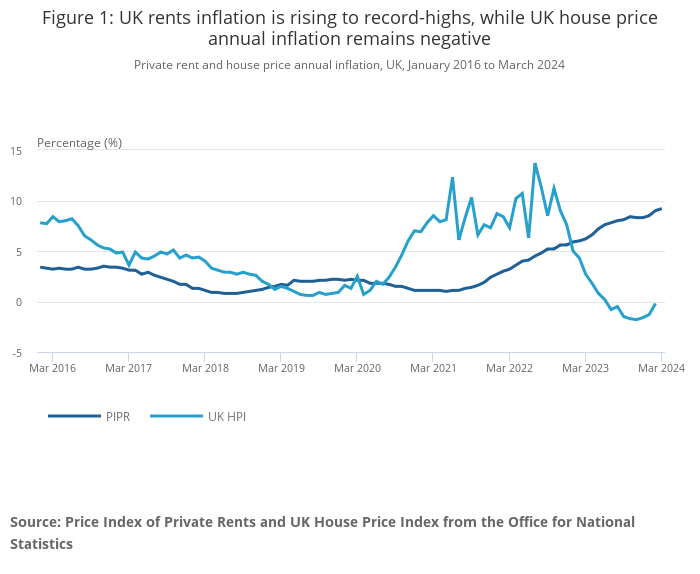

House prices continued to fall in February, but private rents hit their highest level on record, the latest readings from the ONS have found.

UK house prices fell by the least in eight months when the figure edged down by 0.2 per cent on an annual basis in February, against a 1.3 per cent decline in the previous month.

The average price of a property during the month cost £281k, the UK Statistics Authority said on Wednesday.

London was the English region with the lowest annual inflation, where prices decreased by 4.8 per cent in the 12 months to February 2024.

Between January and February, UK transactions increased by 1.2 per cent on a seasonally adjusted basis.

Iain McKenzie, chief of The Guild of Property Professionals, said: “Sellers will be delighted by another month of modest house price growth and this trend could continue as we move through the busy spring and summer months.

“A return to annual growth is now within reach after a difficult year for homeowners in 2023, many of whom may have felt that they had missed a window of opportunity to sell their property.”

He added: “Buyers may not be as excited about the prospect of house prices increasing, but it should be reassuring to know that any purchases made now are unlikely to lose value immediately after they exchange.”

Other groups which measure house prices have also shown a recovery, despite mortgage rates ticking back up.

A recent report by lender Nationwide said house prices grew in March at their fastest rate since December 2022.

Anthony Codling, managing director at RBC Capital Markets, said: “When we consider all the other economic moving parts and political machinations house prices continue to display a high level of stability and seem to be able to weather any storm thrown at them.

“This stability should encourage more people to move home and with wages currently rising faster than inflation, homebuyers may find they have a bigger budget than they thought.”

Rents remain a headache (and London is the worst)

Meanwhile, rental costs in the UK continued to grow with average rents rising 9.2 per cent in March – the highest level since data collection began in 2015.

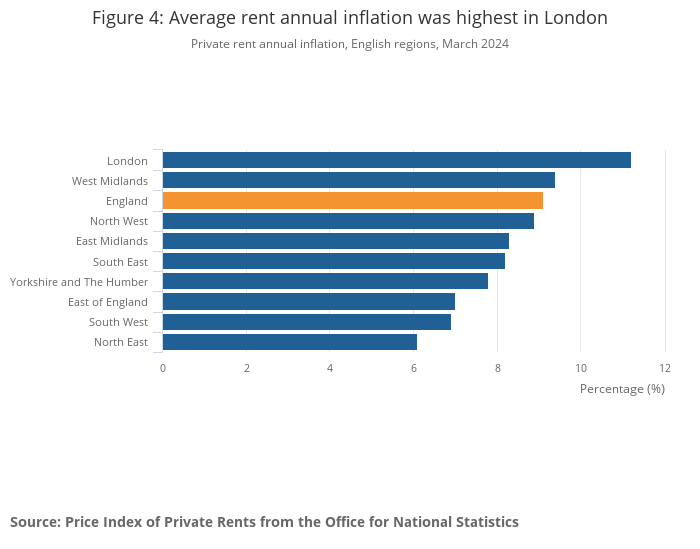

London was the English region with the highest annual rents inflation in the 12 months to March 2024, at 11.2 per cent, which was up from 10.6% in February 2024.

Rebecca Florisson, principal analyst at the Work Foundation at Lancaster University, said: “Inflation might be falling, but those in the private rented sector are in the midst of a cost of renting crisis.”

“The record 9.2 per cent rise on the year is bad news for all renters, who are seeing rents outpace average wage rises of six per cent.”

She added: However, it is particularly challenging for the 1.4 million private renters in severely insecure employment – such as those on zero-hour contracts or in temporary work – who face insecurity at work and at home. This particularly affects severely insecure workers from Black and Asian backgrounds and workers aged 25 to 34.”

“Private renters already spend a higher percentage of their monthly earnings on housing than those in all other forms of accommodation. And insecure workers are particularly vulnerable to the rising cost of rents as they earn on average £3,276 less than those in secure jobs.”