-

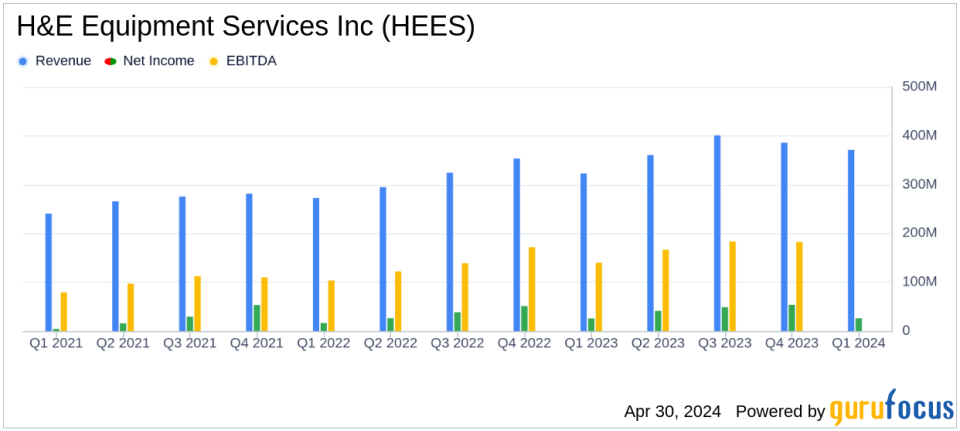

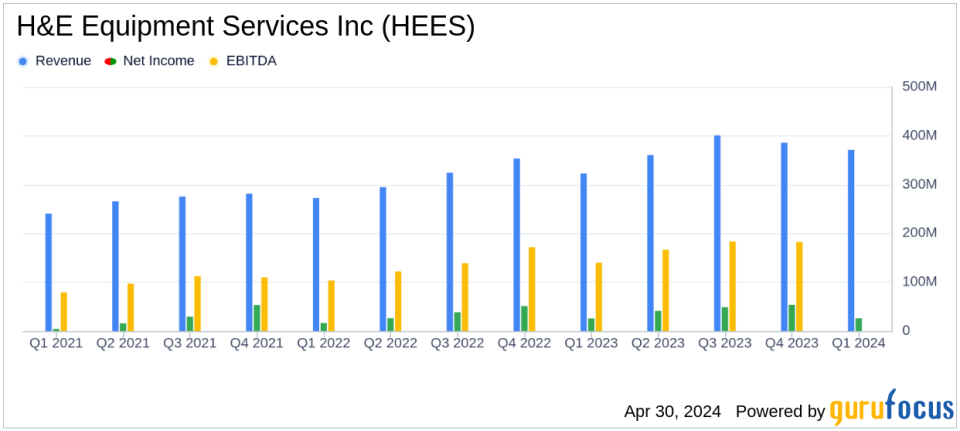

Revenue: Reached $371.4 million, up 15.2% year-over-year, surpassing estimates of $352.52 million.

-

Net Income: Reported at $25.9 million, slightly below the estimated $30.02 million.

-

Earnings Per Share (EPS): Achieved $0.71, falling short of the estimated $0.78.

-

Gross Margin: Improved to 44.4% from 43.8% year-over-year.

-

Equipment Rental Revenue: Increased by 12.7% to $295.3 million, driven by a 12.8% increase in rental revenues to $261.7 million.

-

Adjusted EBITDA: Grew 13.1% to $161.7 million, with an Adjusted EBITDA margin of 43.6%.

-

Rental Fleet Size: Expanded by 15.7% to over $2.8 billion in original equipment cost.

On April 30, 2024, H&E Equipment Services Inc (NASDAQ:HEES) disclosed its first-quarter financial results through an 8-K filing. The company reported a revenue of $371.4 million, surpassing the estimated $352.52 million projected by analysts. However, the net income of $25.9 million fell short of the anticipated $30.02 million. Earnings per share stood at $0.71, slightly missing the forecast of $0.78 per share.

H&E Equipment Services Inc, a prominent integrated equipment services company, specializes in renting, selling, and providing parts and services for heavy construction and industrial equipment. Its primary revenue comes from equipment rentals, with significant operations across various U.S. regions.

Financial Highlights and Operational Challenges

The company’s revenue saw a 15.2% increase compared to the first quarter of 2023, driven by a 12.8% growth in rental revenues and significant gains in sales of rental and new equipment. Gross profit also improved, reflecting a higher gross margin of 44.4% compared to 43.8% in the previous year. Despite these gains, the company faced challenges including a decrease in average time utilization of rental equipment from 67.3% to 63.6%, attributed to reduced construction activity and project delays due to adverse weather conditions, particularly in the western regions.

Strategic Initiatives and Industry Outlook

CEO Brad Barber highlighted the company’s strategic focus on branch expansion and fleet growth, which contributed to financial improvements. The rental fleet expanded by 15.7% year-over-year, reaching an original equipment cost of over $2.8 billion. Looking forward, Barber provided insights into the equipment rental industry, expecting moderate growth influenced by a high-interest rate environment and tighter lending standards which could impact construction spending.

Detailed Financial Performance

The detailed financial statements reveal a mixed performance. While total revenues and gross profit increased, the net income remained nearly flat year-over-year, and SG&A expenses rose by 19.9% due to expansion activities. The company’s operational efficiency, as measured by income from operations, slightly decreased to 14.0% of revenues from 14.5% in the previous year. Interest expenses also increased, reflecting higher debt levels associated with the company’s growth initiatives.

Investor and Analyst Perspectives

The first-quarter results of H&E Equipment Services Inc reflect a company navigating through a complex market environment while maintaining focus on long-term growth strategies. The alignment of actual earnings with analyst projections, coupled with strategic expansions, positions the company favorably among investors seeking steady growth in the industrial and construction equipment sectors. However, the challenges highlighted, including lower utilization rates and increased expenses, suggest areas for potential improvement and cautious monitoring by investors.

For further details, investors are encouraged to review the full earnings report and attend the upcoming conference call scheduled by the company to discuss these results and future strategies.

Explore the complete 8-K earnings release (here) from H&E Equipment Services Inc for further details.

This article first appeared on GuruFocus.