-

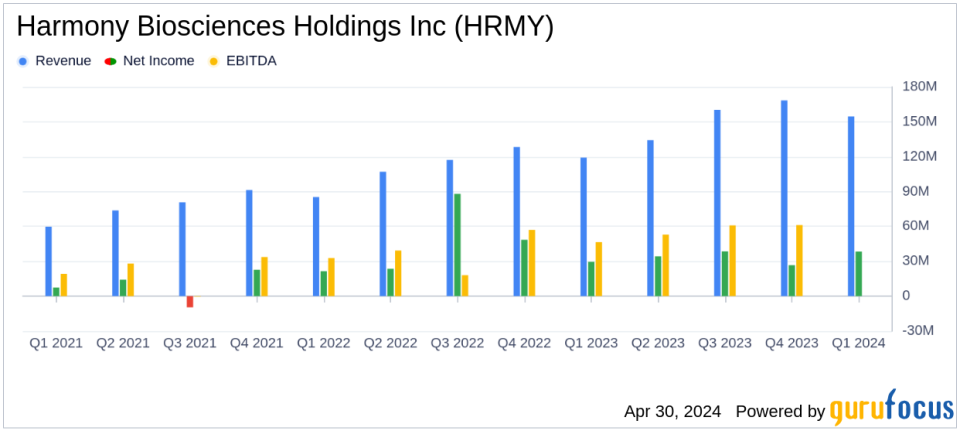

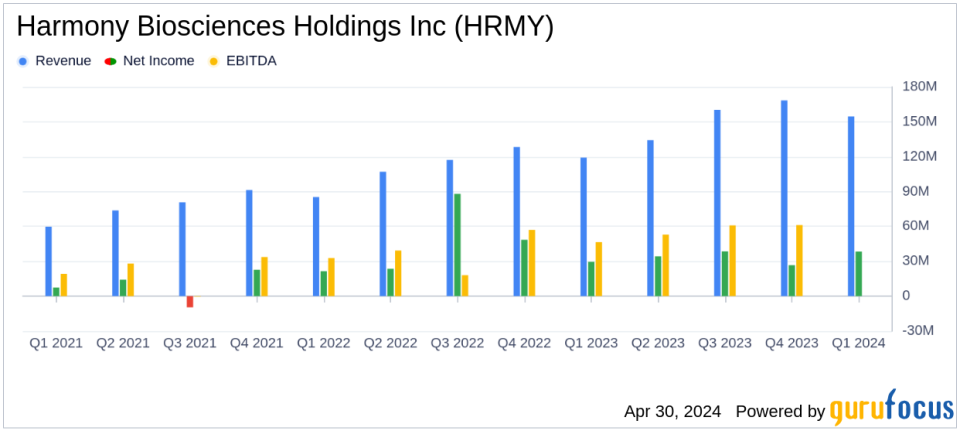

Net Revenue: Reported at $154.6 million for Q1 2024, marking a 30% increase year-over-year, slightly below the estimate of $154.8 million.

-

Net Income: Achieved $38.3 million in Q1 2024, surpassing the estimated $35.72 million.

-

Earnings Per Share (EPS): Recorded at $0.67 per diluted share, exceeding the estimated $0.62.

-

Cash Reserves: Increased to $453.6 million as of March 31, 2024, from $425.6 million at the end of 2023.

-

Research and Development Expenses: Rose to $22.19 million in Q1 2024 from $13.29 million in Q1 2023, reflecting ongoing investment in pipeline expansion.

-

2024 Revenue Guidance: Reaffirmed in the range of $700 million to $720 million, indicating confidence in continued growth.

-

Strategic Acquisitions: Expanded into rare epilepsy markets through the acquisition of Epygenix Therapeutics, Inc., aiming for a potential billion-dollar franchise.

On April 30, 2024, Harmony Biosciences Holdings Inc (NASDAQ:HRMY) released its 8-K filing, disclosing a robust financial performance for the first quarter of 2024. The company reported a significant year-over-year net revenue increase of approximately 30%, with figures rising from $119.1 million in Q1 2023 to $154.6 million in Q1 2024. This performance not only surpassed the analyst’s revenue estimate of $154.8 million but also showcased the effectiveness of Harmony’s strategic initiatives in expanding its market presence.

Harmony Biosciences, a commercial-stage pharmaceutical company, is renowned for its focus on developing and commercializing therapies for patients with rare neurological diseases. Their flagship product, WAKIX (pitolisant), has been a critical driver of revenue growth, particularly in the treatment of narcolepsy.

Financial Highlights and Strategic Developments

The company’s GAAP net income for Q1 2024 stood at $38.3 million, translating to $0.67 per diluted share, an improvement from $29.5 million, or $0.48 per diluted share in the same period last year. This aligns closely with the estimated earnings per share of $0.62, demonstrating Harmony’s consistent profitability amidst expansion efforts. Notably, non-GAAP adjusted net income was reported at $50.7 million, or $0.88 per diluted share, reflecting adjustments for non-cash expenses and other non-recurring costs.

Harmony’s operational strategy in the quarter included significant advancements in its product pipeline and strategic acquisitions aimed at diversifying its portfolio and reinforcing its leadership in the sleep/wake therapy sector. A notable development is the planned submission of a Supplemental New Drug Application for Pitolisant in treating Idiopathic Hypersomnia, expected in the second half of 2024, which could further enhance its market reach.

Operational and Financial Metrics

Reviewing the balance sheet, Harmony reported an increase in cash and cash equivalents, from $311.7 million as of December 31, 2023, to $333.0 million by March 31, 2024. This financial stability is crucial as the company pursues further development and potential market expansions. Total assets also saw a rise to approximately $847.0 million from $811.4 million, underscoring a solid quarter of asset growth.

The company reiterated its full-year 2024 guidance, expecting net product revenues to be between $700 million and $720 million. Additionally, Harmony highlighted its ongoing share repurchase program, with $150 million authorized for stock buybacks, underscoring its confidence in the company’s value proposition to shareholders.

Looking Ahead

As Harmony Biosciences continues to execute its growth strategy, the company is well-positioned to maintain its trajectory of robust revenue growth and profitability. The expansion into rare epilepsy treatments and the advancement of its CNS portfolio are expected to provide substantial long-term value to both patients and investors. Harmony’s proactive management and strategic initiatives are set to potentially lead the company towards achieving a multi-billion-dollar revenue stream well into the next decade.

For more detailed information and to participate in today’s earnings call, investors and interested parties can access the webcast through Harmony’s investor relations page.

Explore the complete 8-K earnings release (here) from Harmony Biosciences Holdings Inc for further details.

This article first appeared on GuruFocus.