In a notable insider transaction, Executive Vice President, General Manager of High Performance Computing & Artificial Intelligence (HPC & AI) at Hewlett Packard Enterprise Co (NYSE:HPE), Justin Hotard, sold 29,315 shares of the company on December 13, 2023. This move has caught the attention of investors and market analysts, prompting a closer look at the implications of such insider activity.

Who is Justin Hotard?

Justin Hotard serves as the Executive Vice President and General Manager of the HPC & AI segment at Hewlett Packard Enterprise Co. His role places him at the helm of one of the company’s most innovative and forward-looking divisions, responsible for driving growth in areas that are critical to the future of computing. Hotard’s insights into the company’s operations and strategic direction make his trading activities particularly noteworthy for investors.

Hewlett Packard Enterprise Co’s Business Description

Hewlett Packard Enterprise Co is a global edge-to-cloud Platform-as-a-Service company that helps organizations accelerate outcomes by unlocking value from all of their data, everywhere. Built on decades of reimagining the future and innovating to advance the way people live and work, HPE delivers unique, open, and intelligent technology solutions delivered as a service spanning Compute, Storage, Software, Intelligent Edge, High Performance Computing, and Mission Critical Solutions with a consistent experience across all clouds and edges, designed to help customers develop new business models, engage in new ways, and increase operational performance.

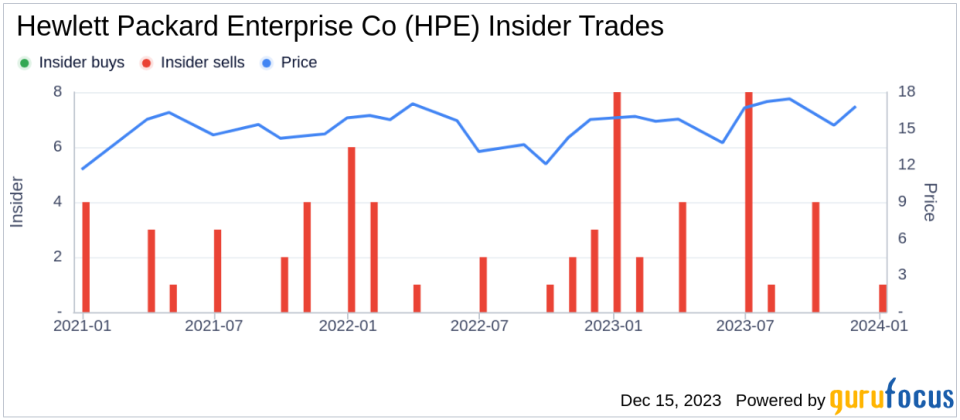

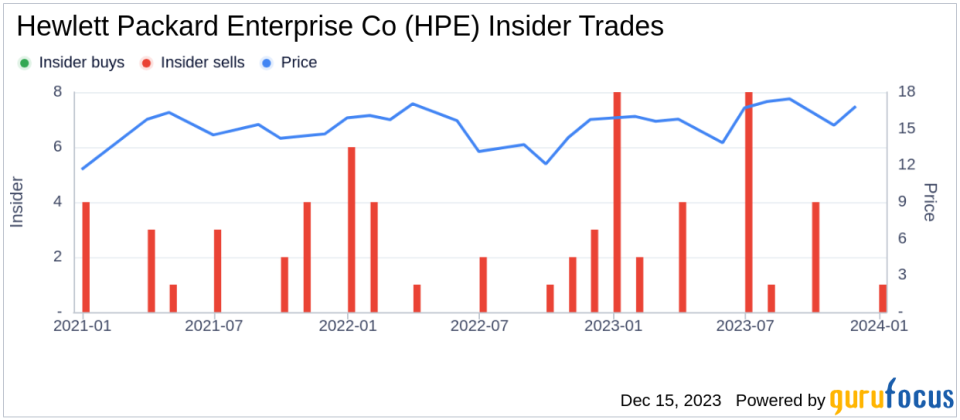

Analysis of Insider Buy/Sell and Relationship with Stock Price

The recent sale by Justin Hotard of 29,315 shares is part of a larger pattern of insider selling at HPE. Over the past year, Hotard has sold a total of 58,998 shares and has not made any purchases. This could be interpreted in several ways. On one hand, insiders might sell shares for various personal reasons that do not necessarily reflect their outlook on the company’s future performance. On the other hand, consistent selling by insiders, particularly those in key management positions, could signal a lack of confidence in the company’s near-term growth prospects.

The insider trend image above shows a clear pattern of insider selling, with no insider buys over the past year. This trend could be a red flag for potential investors, as it suggests that those with the most intimate knowledge of the company’s workings are choosing to reduce their holdings.

Valuation and Market Reaction

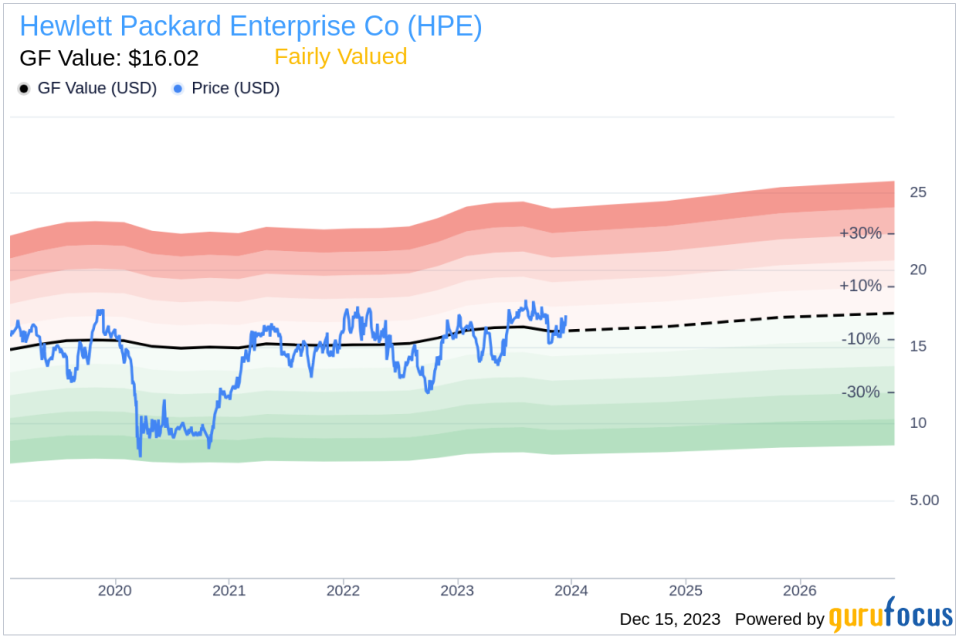

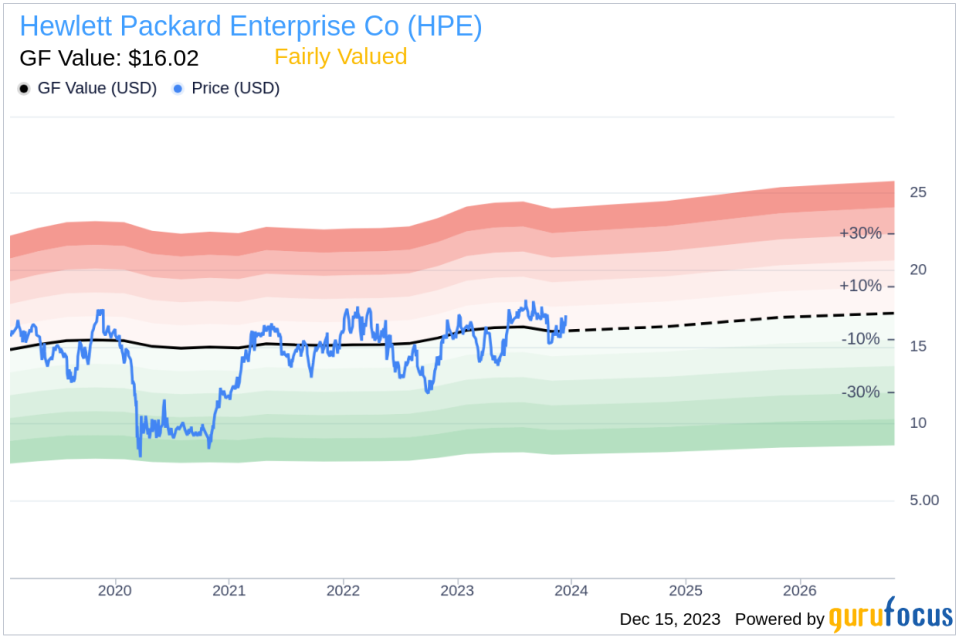

On the day of Hotard’s recent sale, HPE shares were trading at $16.18, giving the company a market cap of $21.89 billion. The price-earnings ratio of 11.08 is lower than both the industry median of 22.75 and the company’s historical median, indicating that the stock may be undervalued compared to its peers.With a price of $16.18 and a GuruFocus Value of $16.02, HPE has a price-to-GF-Value ratio of 1.01, suggesting that the stock is Fairly Valued based on its GF Value. The GF Value is an intrinsic value estimate that considers historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The GF Value image above provides a visual representation of the stock’s valuation relative to its intrinsic value. The proximity of the current price to the GF Value indicates that the market has efficiently priced HPE’s stock, leaving little room for significant upside or downside based on valuation alone.

Conclusion

The recent insider selling by EVP Justin Hotard may raise questions among investors about the future prospects of Hewlett Packard Enterprise Co. While the company’s valuation metrics suggest that the stock is fairly valued, the consistent pattern of insider selling, particularly in the absence of any insider buying, could be a cause for concern. Investors should consider these insider activities as part of a broader analysis of HPE’s financial health, market position, and growth potential before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.