-

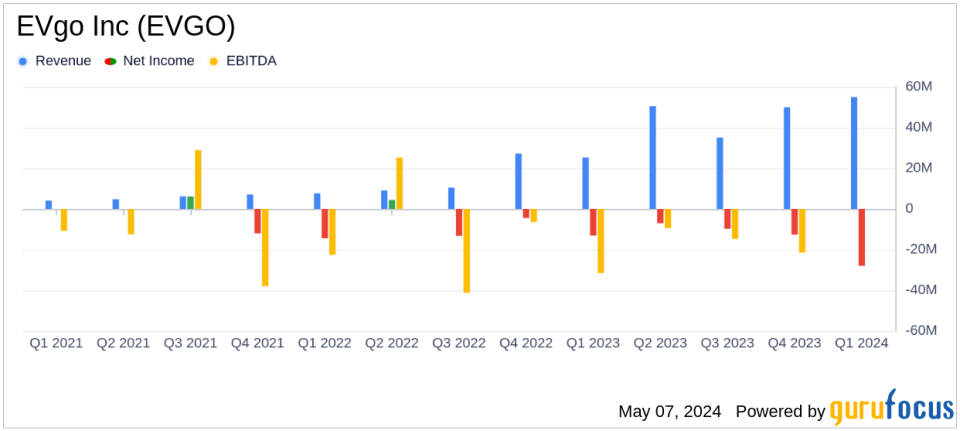

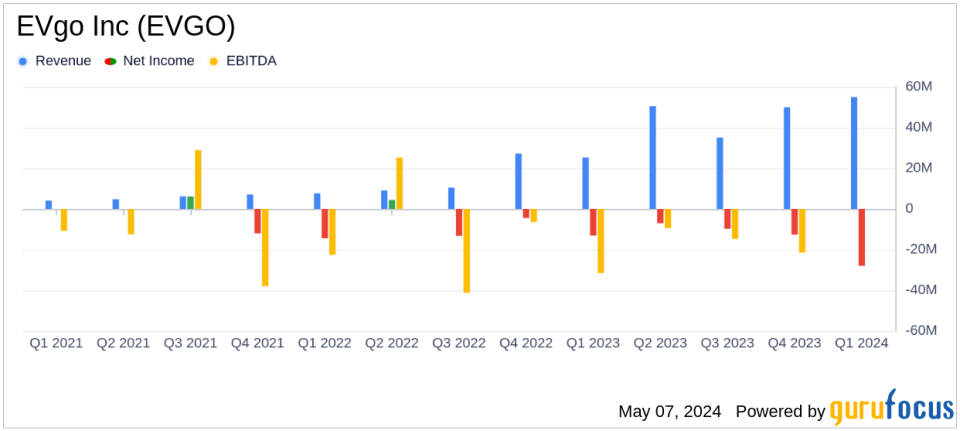

Revenue: Reached $55.2 million in Q1 2024, up 118% year-over-year, surpassing estimates of $52.39 million.

-

Net Loss: Reported at $28.19 million, showing improvement with a 43% decrease from the previous year, but exceeded the estimated loss of $20.55 million.

-

Earnings Per Share (EPS): Posted a loss of $0.09 per share, above the estimated loss of $0.11 per share.

-

Gross Margin: Improved significantly to 12.4% from 0.2% a year ago, indicating better profitability per dollar of revenue.

-

Adjusted EBITDA: Loss reduced to $7.21 million from $20.07 million in Q1 2023, signaling enhanced operational efficiency.

-

Customer Growth: Added nearly 109,000 new customer accounts, a 63% increase year-over-year, with total accounts exceeding 981,000.

-

Network Expansion: Increased total stalls in operation or under construction by 23% year-over-year to 3,780 stalls.

On May 7, 2024, EVgo Inc. (NASDAQ:EVGO) released its 8-K filing, announcing a significant year-over-year revenue increase for the first quarter ended March 31, 2024. The company reported a revenue of $55.2 million, a substantial rise from $25.3 million in the same quarter of the previous year, marking a 118% increase. This performance notably surpassed the analyst estimates which projected a revenue of $52.39 million.

EVgo, a leader in electric vehicle charging solutions, operates one of the nations largest public fast charging networks. The company’s network is designed to support all EV models and meets all current charging standards in the U.S. EVgo’s strategic partnerships span across various sectors, including grocery stores, automotive manufacturers, and local governments, facilitating widespread charging infrastructure deployment.

Financial and Operational Highlights

The first quarter saw a net loss of $28.19 million, an improvement from a net loss of $49.08 million year-over-year. Although the net loss exceeded the analyst’s expectation of a $20.55 million loss, the reduced deficit indicates a positive trajectory in managing operational costs and scaling revenue. Network throughput also experienced a significant boost, with a 194% increase to 53 GWh, up from 18 GWh in the prior year.

EVgo’s CEO, Badar Khan, emphasized the company’s robust business model and operational efficiency, which are expected to lead to an adjusted EBITDA breakeven by 2025. The company’s focus on expanding its fast-charging network and enhancing unit economics underpins its strategy to capitalize on the growing adoption of electric vehicles in the U.S.

Challenges and Industry Outlook

Despite the positive revenue growth, EVgo faces challenges including the need for continuous capital investment and the management of a high net loss. The competitive landscape in the EV charging sector demands ongoing innovation and expansion to stay ahead. Moreover, the upcoming CFO transition with Olga Shevorenkova stepping down could bring temporary uncertainty to the financial leadership.

The company’s reaffirmation of its 2024 financial guidance reflects confidence in its strategic initiatives and operational adjustments expected throughout the year. EVgo continues to leverage government programs and partnerships to enhance its service offerings and infrastructure capabilities.

Summary of Financial Performance

The detailed financial results reveal significant improvements in gross profit and adjusted EBITDA. Gross profit rose dramatically to $6.84 million from just $41 thousand in Q1 2023, and the adjusted EBITDA loss was reduced by 64% to $7.21 million. These figures demonstrate EVgo’s ability to optimize its operations and manage costs effectively amidst rapid expansion.

Overall, EVgo’s Q1 2024 performance illustrates a company on a clear growth path, with substantial improvements in revenue and operational metrics. The challenges ahead involve sustaining this growth momentum while managing the transition in financial leadership and continuing to innovate in the fast-evolving electric vehicle market.

Explore the complete 8-K earnings release (here) from EVgo Inc for further details.

This article first appeared on GuruFocus.