Even before P&O Ferries’ owner pulled out of Monday’s International Investment Summit, Sir Keir Starmer had a fight on his hands to make the event live up to its star-studded billing.

In opposition, Labour had promised to hold an international summit within 100 days of coming to power. However, the omens didn’t look good.

JP Morgan’s chief executive Jamie Dimon was too busy. Billionaire investor Steve Schwarzman, founder of Blackstone, had other plans.

The move by DP World – the Dubai-based owner of P&O Ferries – to quit the summit and pause a £1bn investment has added to the gloom.

In the build up to the event, which will be held at the Guildhall in the City of London, much of the coverage has focused on which Wall Street executives were planning to jet in – and those who were to be conspicuously absent.

Yet in Whitehall, the focus has been as much on Paris as New York.

“The French always put on a bit of a show. The name of the game is to make sure we do it better than France,” says one government official. “These guys don’t come over to sit in a big room in uncomfortable chairs to listen to six or seven hours of panel discussions.”

When Rachel Reeves and Sir Keir Starmer give their stump speeches about why the world’s money managers should put their cash into Britain, they know they will be up against their old European rival across the Channel.

“The Americans will compare what we do in the UK to Paris,” one financier stresses. An executive at a US company whose chief executive is invited says the French version is considered a “model in how you organise these events”.

At the annual Choose France summits that President Emmanuel Macron established in 2018, investors are invited to the Palace of Versailles to meet personally with Macron.

Investors say they find it easier to deal with France because Macron picks up the phone, with top chief executives receiving texts directly from him inviting them to the Palace of Versailles.

In stark comparison, billionaires expected to be at a drinks reception at Lancaster House near Buckingham Palace on Sunday were wavering about flying over just 48 hours before the event.

After complaining of difficulties engaging with the Tories, investors were hoping for a slicker start under a new Government. Instead, there has been frustration about the clunky timing of the event – held weeks before Rachel Reeves’s expected tax raid in her first Budget – and a lack of organisation.

In the week leading up to the summit, some invitees reportedly received out-of-office responses to urgent questions from organisers, who also accidentally revealed the email addresses of guests in an email about the event.

The Government only just managed to appoint an investment minister days before the opening reception – Poppy Gustafsson, co-founder of Darktrace, the Mike Lynch-backed cybersecurity company that was sold to an American private equity buyer at the start of this month.

Ministers will be hoping that the glamour of the event will wash away any memory of these early frustrations.

After drinks on Sunday night, the summit will officially kick off the next day in the City of London. The event will be compered by Bridgerton actress Adjoa Andoh and feature speakers including former England football manager Gareth Southgate. A dinner will follow in St Paul’s Cathedral. Goldman chief David Solomon, Google’s ex-boss Eric Schmidt and BlackRock chief Larry Fink are among those expected to attend.

The Government is hoping to attract a rush of cash. However, it has suffered a major blow after ports giant DP World pulled a scheduled announcement of £1bn worth of investments following criticism by deputy leader Angela Rayner of its subsidiary P&O Ferries.

Britain desperately needs the investment summit to succeed.

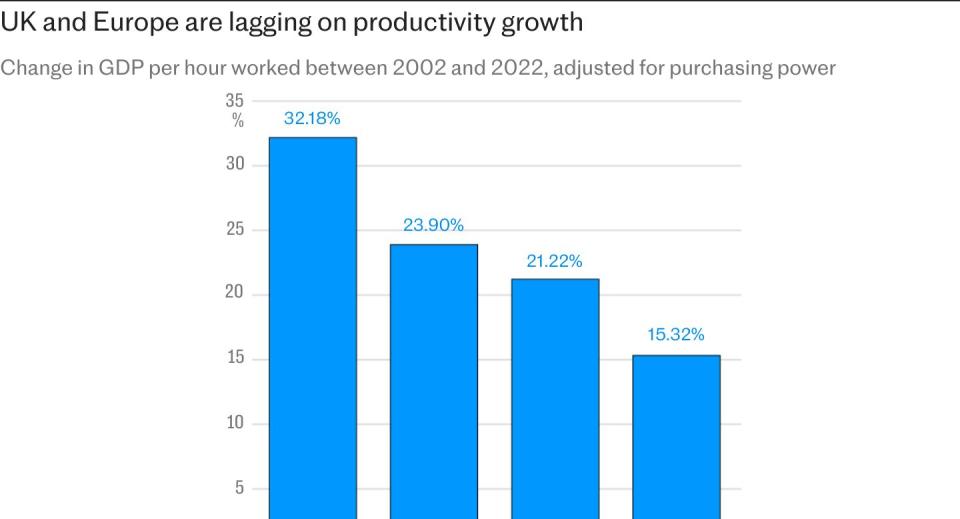

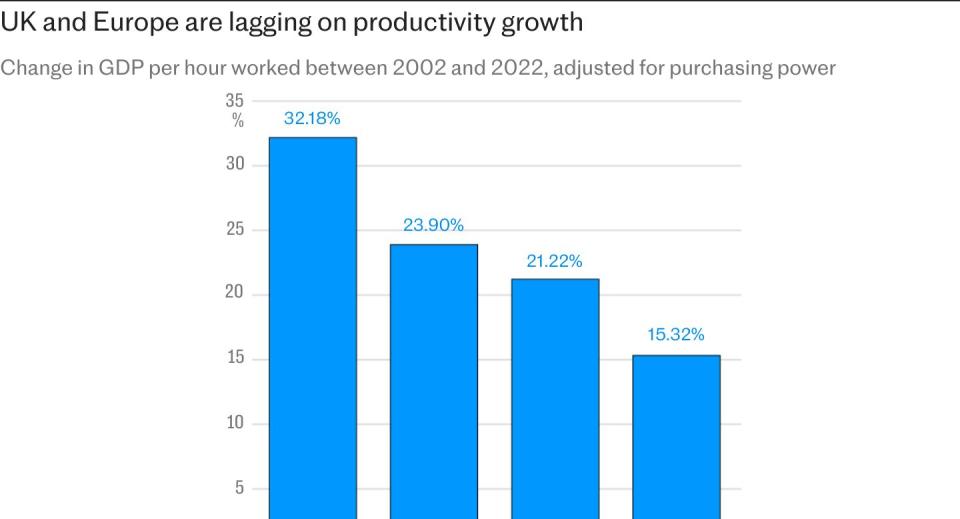

The country has been bottom or second-bottom of the G7 league tables for total economy investment across businesses, households and the public sector for decades.

Lord Harrington, who was commissioned by Jeremy Hunt to lead the report into the UK’s foreign investment, found last year that the UK was “disorganised, risk-averse, siloed and inflexible”, with financial decisions shoved to a “series of semi-arm’s-length institutions”.

“What’s let us down in the past is the delivery,” Harrington says. “We raise expectations very well, we’re very good at it, but it’s the operational delivery of it that we need the reorganisation of government to do.”

Investors seeking to back Britain often find themselves passed between departments, in contrast to Macron’s efforts to offer a personalised service.

“We need to be more proactive, not just reactive,” says Harrington. “I’m hoping that we have an industrial strategy that will say ‘we can’t do everything, we’re not the United States, but we can work out what sectors we wish to excel in’.”

Ministers are expected to confirm a new “concierge service” for investors at the summit, which aims to fix some of the operational issues that have plagued government.

The stakes are high. A lack of investment is seen as a fundamental flaw in our stuttering economy. Not only does it hold back growth, but it is a crucial factor in hurting productivity growth as poor infrastructure, expensive housing and under-capitalised businesses prevent workers from reaching their potential.

Productivity has been a major problem since the 2008 financial crisis. In the 11 years before the crash, productivity grew by more than 25pc. In the decade and a half since then, it has edged up by less than 6pc.

Benjamin Nabarro, an economist at Citi, says that foreign direct investment in infrastructure projects such as roads, railways and ports is in many ways preferable to investment by the Government, not least because it means the Treasury does not have to ramp up borrowing to get Britain building.

A less appreciated aspect is the extra productivity foreign investors bring to businesses in Britain. International money comes with technical knowledge, extra contacts for trade, and often better management skills too, says Yael Selfin, the chief economist at KPMG UK.

“It is not just the know-how or practice of production, it is also the know-how of other markets, which you can potentially reach out for supply chains or for exports,” she says. “There is a correlation of a rise in productivity and more exposure to outside markets.”

A study by the ONS showed that companies in Britain with a significant foreign ownership stake were on average almost 75pc more productive than similar competitors that were not in receipt of international investment.

Nabarro says getting those more productive global businesses to invest in the UK will be critical to restarting growth.

“That, historically, has been an important engine of UK productivity growth in terms of sharing best practice and driving those productivity improvements,” he says.

“A really good example of this in the UK is the automotive sector, where firms like Nissan have invested heavily in trying to share expertise with their domestic supply chain, and that is because they have an interest in those firms becoming more productive.”

Still, some in the City have their doubts as to whether the event will have any impact.

“The event is probably likely to be showy and ineffective,” shrugs Jon Moulton, the former Tory party donor who founded turnaround fund Better Capital.

As the event kicks off, Reeves and Starmer will be hoping they can prove him wrong.