Apartment prices and rents in Cyprus defied broader market declines during the third quarter of 2024, reflecting strong demand, according to a report from real estate analytics firm Ask Wire.

At the same time, the report showed that other property types struggled under the weight of high interest rates and shifting buyer preferences.

The report is based on the firm’s internal index. The index offers a detailed view of property sale and rental values across all districts and property types, drawing from data dating back to 2009.

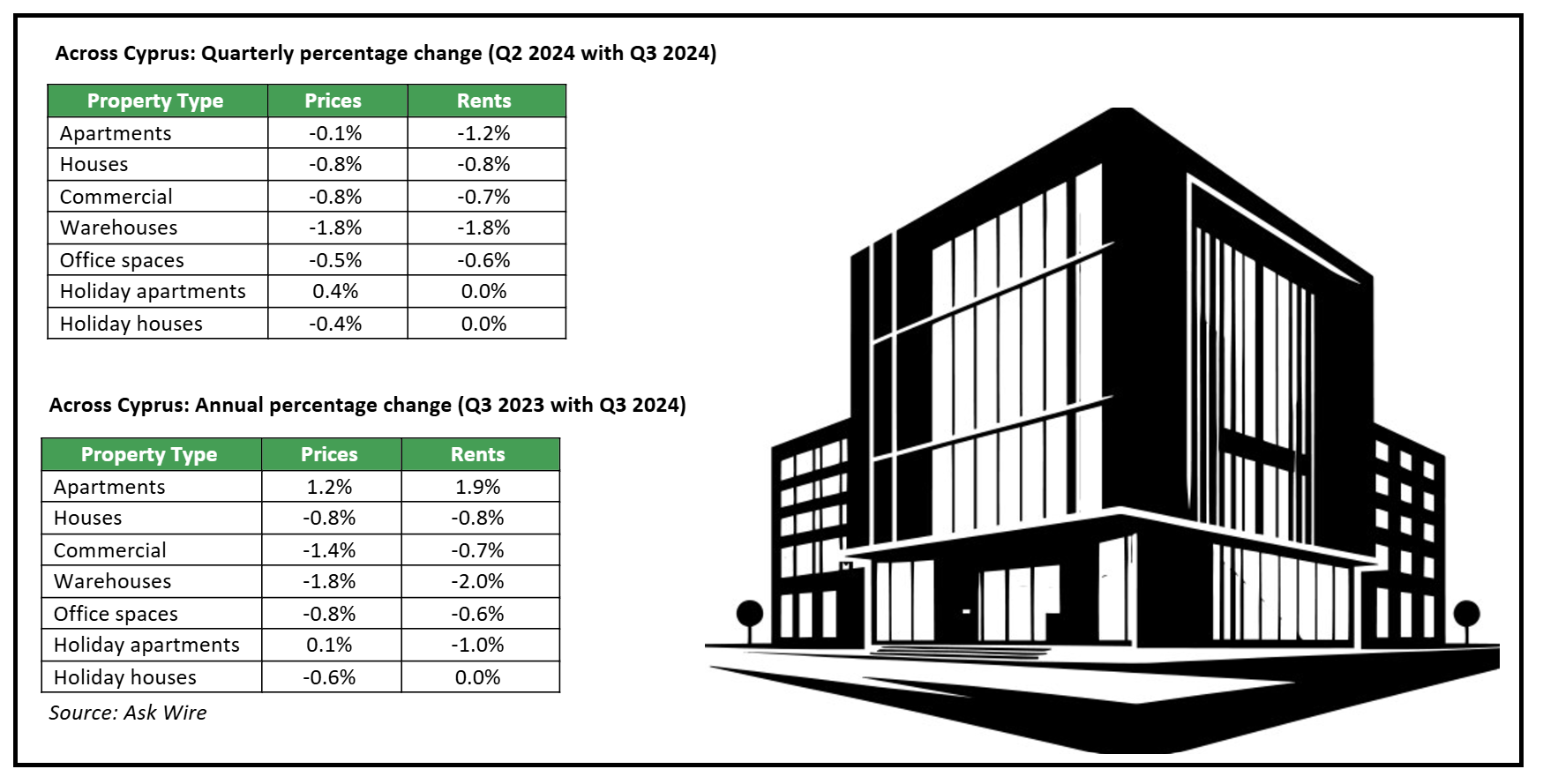

According to the firm, apartments in Cyprus demonstrated resilience with a 1.2 per cent year-on-year increase in sale prices, bolstered by robust demand.

Holiday apartments also saw a marginal annual rise of 0.1 per cent year-on-year.

However, other property types experienced declines, when compared to last year, with warehouses falling 1.8 per cent, retail spaces 1.4 per cent, and houses and offices both dropping by 0.8 per cent.

On a quarterly basis, declines were noted in most categories, except for holiday apartments, which recorded a 1.4 per cent increase.

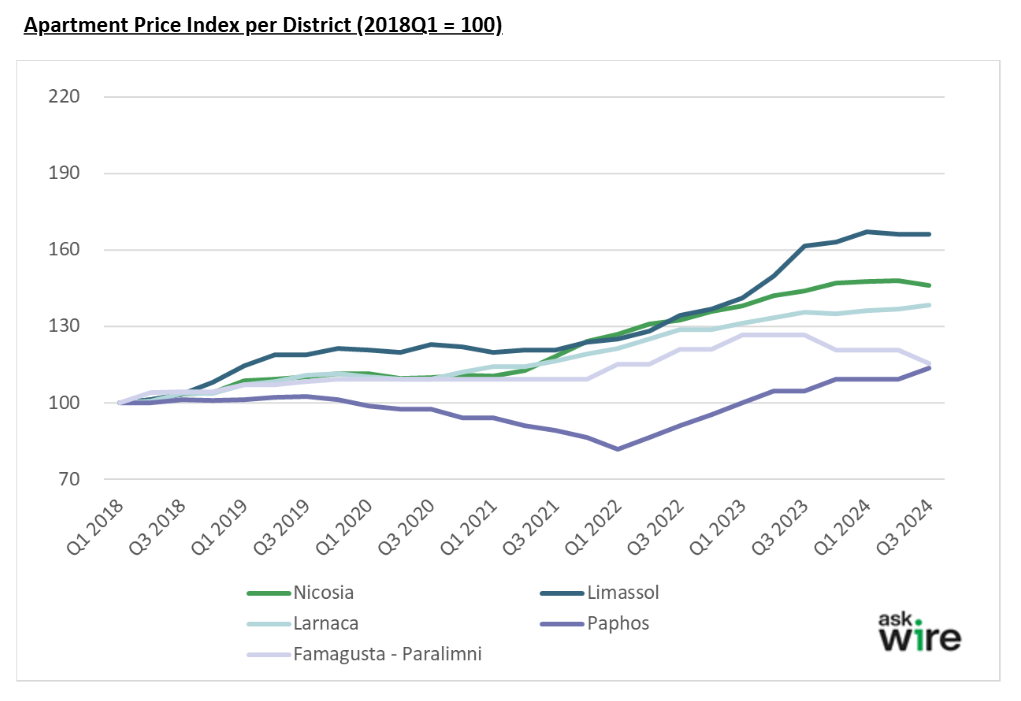

The report pointed out that price decreases were observed across all districts, although Larnaca showed relative stability.

Annual rental values for apartments grew by 1.9 per cent, highlighting continued demand in this segment.

Conversely, other categories experienced declines, including warehouses (-2.0 per cent), houses (-0.8 per cent), and retail spaces (-0.7 per cent).

Holiday house rents remained stable year-on-year, providing a rare area of consistency in an otherwise fluctuating market.

On a quarterly basis, apartment rents fell by 1.2 per cent, warehouses by 1.8 per cent, and houses by 0.8 per cent.

Holiday rentals stayed stable across most districts, with only slight decreases in Nicosia and Limassol.

Pavlos Loizou, CEO of Ask Wire, commented on the challenges facing the market, saying that “the Cyprus property market is navigating various challenges“.

According to Loizou, these include “elevated construction costs and disruptions to the supply chain, influenced by ongoing geopolitical tensions”, noting that these factors continue to shape property prices and demand patterns.

He also mentioned that “high mortgage rates are adding pressure to affordability, particularly in the middle and lower segments, tempering overall demand”.

Moreover, Loizou stressed the importance of prudence for stakeholders. “For investors and lenders, the convergence of high interest rates, construction costs, and regional instability underscores the need for caution in the near term,” he said.

“As we look to the fourth quarter and into 2025, we anticipate more selective investment, with stability expected in certain asset types as the market continues to adjust,” the Ask Wire CEO concluded.